https://news.zol.com.cn/835/8353750.html

news.zol.com.cn

True

https://news.zol.com.cn/835/8353750.html

Report

752

Xiaomi’s official direct-operated store has a limited-time promotion today, and the price of Xiaomi Xiaoai Speaker Pro has dropped to 249 yuan. At the same time, you can return 20 quintillion beans to the sun, which is equivalent to only 229 yuan. Old JD.com PLUS members can also receive a 200-10 yuan full-product coupon, which is as low as 219 yuan after stacking (239 yuan actually paid). Xiaoai Speaker Pro adopts a black appearance design, supports stereo combination and nearby wake-up function, adopts 750mL oversized sound cavity, 3…

分类: gkjdfkgd

Looking forward to full! The comfort of Tiggo 9 is too worth seeing.

Nowadays, consumers’ demand for cars has been greatly upgraded, which is not only reflected in the high-quality requirements of functional configuration, but also in the desire for all-round comfort. As a national brand that always takes users as the center, Chery, with its continuous exploration of cutting-edge technologies, has incorporated many cutting-edge technologies into the brand-new Tiggo 9, greatly enriching the choice of national vehicles. As a popular car series owned by Chery, Tiggo has been successful all over the world. This time, Tiggo 9 is the first mass-produced car carried by Chery’s "Eta Ursae Majoris 2025" strategic scientific research achievement "Mars Architecture-Super Hybrid Platform". First of all, compared with the joint venture models, the self-owned brand models have natural configuration and technical advantages at the same price, and Chery, which has put the latest CDC "magnetic suspension" technology into the 200,000-class SUV market, makes the joint venture car companies feel full of pressure. It is the greatest sincerity of Tiggo 9 to give the latest and best technology to thousands of consumers at this stage.

Deep research on driving & riding somatosensory, creating a new generation of comfortable flagship

Nowadays, people’s pursuit of comfort is better than before. Different from the past, this pursuit of comfort is not only reflected in the visible level of driving comfort, but also in the comprehensive perception of dynamic driving at all times. In order to optimize it, the Tiggo 9 is equipped with CDC "magnetic suspension", and users can adjust the suspension’s softness and hardness infinitely according to their personal preferences. Its built-in super AI algorithm can realize the dynamic feedback adjustment of 1000 times per second, and through intelligent induction adjustment, it can easily pass on various roads, even in extreme situations such as strong bumps, and it can ensure driving comfort. In the past, the active suspension similar to the CDC system could only be seen in millions of high-end luxury cars. This time, Chery’s deployment of such luxury cars to the Tiggo 9 in the 200,000-class SUV market will obviously touch many people’s excitement.

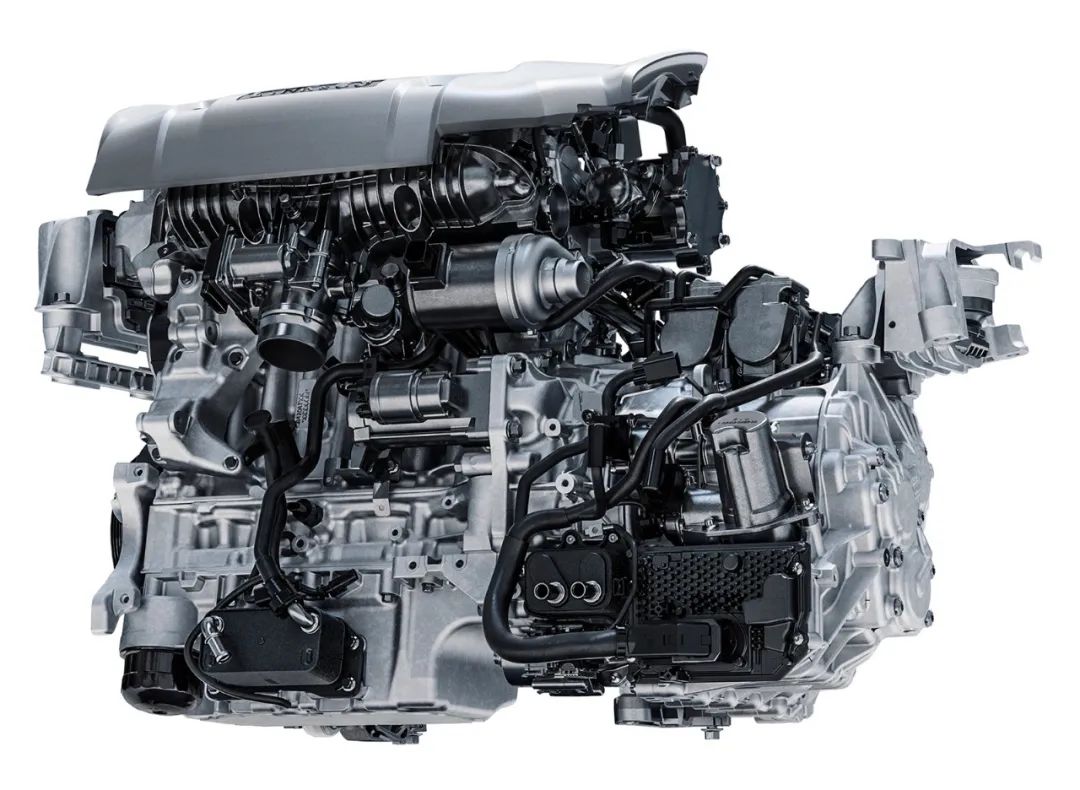

In addition, the Tiggo 9 is equipped with the Kunpeng Power 2.0TGDI engine, with a maximum power of 192kW and a peak torque of 400N·m, which will bring users a comfortable pleasure. The launch of the fuel and hybrid versions will also meet the needs of more levels of vehicles, and there are as many as seven driving modes such as economy, standards, sports and sand, which will make it have the passing performance of driving all terrain.

In addition, in terms of static comfort, Tiggo 9 has created a luxurious cockpit with multi-sensory comfort. From the dimensions of human perception such as space, temperature, vision, touch, smell, hearing, etc., we will comprehensively enhance comfort and dignity. In terms of temperature adjustment, Tiggo 9 has built a 540-dimensional extrasensory air conditioning system, with the most 27 air outlets in the same class and the B-pillar air outlet only available in millions of models, which makes the temperature adjustment faster; The "zero gravity" luxury seat wrapped in Nappa leather can keep the human body in the most natural state of relaxation, and properly support the package and body touch, which is also comparable to luxury models; C-PURE Chery net cubic green cockpit with advanced fragrance can make people gain healthier emotional value.

Global five-star safety endorsement, each journey is responsible for peace of mind.

The foundation of product trust comes from the last barrier of safety. Chery Automobile has established a global quality management system based on global market user data, and the Mars architecture-super hybrid platform is developed according to the world’s highest five-star safety standards. The whole vehicle has passed the four tests of Asia C-NCAP, Europe E-NCAP, Latin America L-NCAP and Australia A-NCAP, and all of them have reached the five-star standard. With the integration of active and passive safety technologies, the passive safety system can intervene and protect 2 seconds in advance, and be responsible for the safety of users.

In addition, the Tiggo 9 is also equipped with the industry’s highest 10 airbags, including the rare "far-end airbags". It is installed on the inner side of the backrest of the main driver’s seat, which can cushion the collision between the main driver and the co-pilot when the vehicle collides, and at the same time, it can also cushion the impact of passengers and the central control armrest, seat door panel and interior decoration, thus ensuring the safety of the main driver and the co-pilot. At present, there are few car companies equipped with far-end airbags in China, only Volvo high-end brand models, Tesla and other 500-100 million models are equipped. It is reported that Chery Mars Architecture-Super Hybrid Platform is the industry’s first platform for mass production of remote airbags, and the world’s top safety and quality guarantee is of course worthy of more trust from users. As the first mass production model of the platform, together with such leapfrog safety configuration, Tiggo 9 will open the era of upgrading the experience of its own 200,000-class SUV.

Sensitive human-computer interaction, touching the smart ceiling

For automotive products that have come to the intelligent age, chip performance is related to the most basic user experience. Tiggo 9 is equipped with Qualcomm Snapdragon 8155 chip and 5G Gigabit Ethernet and other ceiling-level hardware devices in the industry, enabling it to achieve the world’s leading high-performance car experience. In terms of computing power support, the CPU of Tiggo 9 exceeds the mainstream car by 280% with its 105K computing speed, far exceeding the expectations of customers for smart cars at this stage. It can reach the level of turning on the car in 5 seconds and giving voice response within 0.5 seconds, realizing real responsiveness. In addition, it also supports services such as FOTA and remote upgrade, so that the intelligent experience can keep up with the times and be continuously upgraded.

Based on this software and hardware system, the Tiggo 9 has realized the L2.9 intelligent driving assistance system, which covers the functions of parking service, automatic lane change, automatic navigation, etc., so as to reduce the driver’s burden to the greatest extent, and enable users to enjoy the unparalleled intelligent car experience in terms of auxiliary functions beyond the current market standards.

With high-end driving and control, global five-star safety presentation, and intelligent level beyond the times, Chery, a national enterprise, is a leader and constantly gives better product experience to consumers in China. With the long-term return of independent research and development, Chery has been able to decentralize all kinds of high-end technologies in the 200,000-level market, take users as the center, and let luxury car technology enter more people’s lives. This operation will undoubtedly aggravate the "involution" of the industry, and then bring more large and comprehensive experiences to users, accelerating the iterative upgrading of the industry, and the future is expected.

Wuxi Volvo V60 price cuts! The special price is 315,800, so act quickly.

In the Wuxi preferential promotion channel in car home, we are pleased to announce that it is currently in progress, offering a maximum discount of 36,700 yuan. The starting price of this luxury model in Wuxi is 315,800. If you are interested in this model, you can click "Check the car price" in the quotation form to get a higher discount.

The design of Volvo V60 is full of modernity and technology, and the front face adopts a unique Volvo family-style design language, which is highly recognizable. The air intake grille adopts a classic hexagonal design, with chrome trim and black high-gloss material, which looks atmospheric and exquisite. The body lines are smooth, and the overall style is simple without losing the sense of strength. The side lines are smooth and dynamic, and the roof lines are smooth and natural, creating a sense of movement. The tail design is simple and generous, and the taillight adopts the unique Volvo’s iconic "C" design, which is more fashionable with chrome-plated decorative strips. The overall design is full of modernity and technology, showing the high-end temperament and unique design style of Volvo brand.

Volvo V60 is a medium-sized station wagon with a body size of 4778*1850*1437 and a wheelbase of 2872 mm.. The side lines of the car body are smooth, the overall shape is beautiful, and the roof lines are tilted backwards, which highlights the dynamic style. The front and rear wheels are made of 235/45 R18 tires, and the front and rear wheels are designed with five spokes, which is simple and elegant. The tire and rim design of the car not only increases the aesthetics, but also improves the handling performance and driving comfort of the vehicle.

The interior design of Volvo V60 is simple and exquisite. The overall style is mainly Nordic style, and a large number of soft materials and high-grade leather are used to create a comfortable and high-end driving experience. The steering wheel is made of leather, which supports manual adjustment up and down and back and forth, so that the driver can adjust the position of the steering wheel according to his own needs. The central control screen has a size of 9 inches and is equipped with a voice recognition control system, which can control functions such as multimedia system, navigation and telephone, making driving more convenient. The front and rear rows are equipped with USB and Type-C interfaces, which is convenient for passengers to connect devices. The main and auxiliary seats all support electric adjustment, including front and rear adjustment, backrest adjustment, height adjustment, leg rest adjustment and lumbar support. The driver’s seat and the co-pilot seat are also equipped with heating function. The rear seats support proportional tilting, providing more storage space. Generally speaking, the interior design of Volvo V60 is full of humanization, providing comfortable and intelligent driving experience for drivers and passengers.

The Volvo V60 is powered by a 2.0T 250 HP L4 engine with a maximum power of 184 kW and a maximum torque of 350 N m.. The car is equipped with an 8-speed automatic transmission, which can provide drivers with a smooth shift experience. This engine performs well in power output, and can provide enough power for the vehicle, so that the driver can enjoy a comfortable and strong driving experience. At the same time, the high efficiency of the engine can also ensure low fuel consumption and bring better experience to users.

In this automobile market full of opportunities and challenges, Volvo V60 has been attracting consumers’ attention with its excellent quality and performance. Now, in order to give back to the support and love of the fans, we have specially launched a series of preferential policies to enable more consumers to own this excellent luxury station wagon. Now, you can not only enjoy a discount of up to 10,000 yuan, but also get a series of car purchase benefits, including free car maintenance, extended warranty period and customized car purchase plan. If you have always dreamed of owning a luxury station wagon, don’t wait any longer now, take action immediately and make your dream come true!

It was listed in May 2023, and the official map of Chery Tiggo 9 was released.

Recently, the official map of the new medium-sized SUV—— of Chery Automobile, the Tiggo 9 model, was officially released. It is reported that the new car will be officially listed in May this year.

According to the official map released, the new car adopts the latest family style in design, and the front grille adopts polygonal design, which has a very considerable size, supplemented by straight waterfall design and a large number of chrome-plated materials, which enhances the momentum of the front face. The headlights of the new car have also adopted a brand-new style, and the slimmer shape is matched with many lines raised in the hood area, which adds a three-dimensional sense to the front face.

On the side of the car body, a straight waistline runs through the whole side of the car, and combined with the black trim on the upper skirt, the side of the car looks very layered. In addition, the suspended roof, two-color whirlwind wheels and hidden door handles also make the car side more atmospheric. In terms of body size, according to the declaration information previously exposed, the length, width and height of the Tiggo 9 are 4820/1930/1699mm and the wheelbase is 2820mm respectively.

At the rear of the car, the taillights of the new car adopt the popular penetrating design, and the spoiler and high-position brake lights at the roof position are combined with chrome-plated exhaust at the top and bottom sides, showing a good fashion atmosphere and sense of movement.

In terms of interiors, there is not much information at present, but it is reported that the new car will be equipped with rich functional configurations such as 5G interconnection and Queen’s car, which is further close to the current consumer preferences. In the power part, Tiggo 9 will be equipped with Kunpeng Power 2.0TGDI engine with a maximum power of 187kW.

Chengdu man reported to the police: I switched the famous wine in my car and parked in the teahouse. Brother: Wrong.

On May 30, when Mr. Li took the wine, he found that the marks on the outer packaging were gone.

The teahouse on behalf of the parking brother shouted, and the police have been involved in the investigation.

I spit

I made an appointment with a friend in the teahouse. When parking, the waiter in the teahouse parked the car for me. Before parking, I made a special mark on the outer packaging of the famous wine in the trunk. As a result, when I picked up the car, I found that the mark was gone. I suspected that the famous wine in the car had been transferred.

For the convenience of customers, many hotels and teahouses have successively launched "parking service" service. On the 30th, this service caused quite a dispute, and customers and teahouse staff even went to the police station.

At 1 pm on May 30th, Li Yun (a pseudonym) and his friends talked about business at the "Southern Metropolis" teahouse in Tianyi Road, Chengdu. When he saw parking service’s business, he conveniently handed the car keys to the parking brother. Half an hour later, Li Yunwang looked at the trunk and said, "This bottle of wine is definitely not mine. When I gave you the car, I drew a line on the outer packaging ‘ Z’ Glyph marks, but the special marks on this wine box are gone. "

At present, the police have extracted the fingerprints of the trunk of Li Yun’s vehicle and are conducting further investigation.

The customer called the police: "The wine in my trunk was changed."

At noon on the 30th, Li Yun made an appointment with a friend to talk about things at the "Southern Metropolis" teahouse in Tianyi Road, Chengdu.

After 1 o’clock, he drove to the teahouse. "The parking spaces nearby are very tight, and the brand of parking service stands at the entrance of the teahouse." Liu Yun said that when he saw that it was all parking service from the teahouse, he handed the key to the staff.

After recording, the staff handed him a small sign "No.31", "Take the car with this small sign when you leave." Liu yun took the sign, opened the trunk and looked at it, and hurried upstairs.

About half an hour later, Liu Yun finished talking and handed the small card to the teahouse. A few minutes later, the staff stopped the car in front of him. After getting the car keys, Liu Yun opened the trunk again. "Hey, no, this wine is definitely not the bottle just now." Subsequently, Li Yun called the police.

The wine in the trunk of Liu Yun is a bottle of LU ZHOU LAO JIAO CO.,LTD National pits 1573. He said it was wholesaled from the factory before, and now there is only the last bottle left.

"I have heard of parking service before, and there are things in customers’ cars that have been switched." Liu Yun said that before he went upstairs, he deliberately opened the trunk and took a look, and made a "Z" shape on the outer packaging of the bottle of wine with his nails. After taking it to the car, he didn’t see this special mark on the outer packaging of the wine.

Soon after, he found that a carton containing mineral water was missing in the trunk, which further convinced him that someone had moved the trunk.

2 Next page at the end of the page

After five years of market experience, how should we evaluate Geely’s CMA architecture now?

?By 2020, when it comes to the R&D and production of automobiles, it must be inseparable from such terms as "platform" and "architecture". In the past ten years, most automobile manufacturers with a certain scale have launched so-called platforms or architectures, such as the famous MQB, the PSA Group EMP, which is not a big hit, and TNGA, which came from behind.

After the acquisition, the biggest move can be said to be to jointly develop the CMA architecture, whose full name is Compact Modular Architecture, which was developed in the China-Europe R&D Center (CEVT) in Gothenburg, Sweden, while CEVT was a European R&D center established by the holding group in 2013 with global resources.

Nowadays, we can see that there are more and more models developed based on CMA architecture, including branded models, branded models and every brand model that has come out so far. In this case, it is time for us to summarize the characteristics of CMA architecture in many products. Of course, there are advantages and disadvantages in these characteristics.

variety

Many models have been born under CMA framework, among which only 01, 02, 03, 05 and the newly released 06 have covered many different types of models, including SUV, crossover, car and coupe SUV.

In fact, for any modular architecture or platform, it is only a basic project to be compatible with different vehicle types. For example, as small as polo and as large as Touang, they are all products of MQB platform, and the TNGA architecture basically covers all new models and. Therefore, for the CMA architecture of-,it is not a miraculous thing to develop a variety of models based on it, but it is just a matter of doing its job.

So what does diversity mean here?

Actually, it refers to the diversity of personality. Some time ago, whenever we talked about the MQB platform, we would think that most MQB platform cars are the same model, and there is not much difference between models, and even there will be similar driving quality of models with different positioning heights. This is how the legendary platform without (m) area (q) and (b) came into being, and there is a view that hundreds of thousands of MQBs are more worth buying than 200,000 or even 300,000 MQBs.

However, in the CMA architecture, different models still have different personalities.

For example, 03+ and 05 equipped with the same powertrain are completely different in driving experience. I know you will say that 03+ is a performance car with special positioning, and the driving experience must be different, but this personality difference can also be reflected in other models. For example, 01 and 05, 01, which are both SUV foundations and have similar sizes, are relatively more comfortable, while 05′ s chassis is more sporty in terms of lateral support.

In addition to the diversity of personality, CMA architecture also has diversity in the types of powertrain.

In terms of traditional fuel power, CMA architecture provides a variety of combinations of engines and gearboxes. The engines are 1.5T and 2.0T, and the matching of gearboxes will be selected according to different models or even different driving forms. At present, gearboxes appearing on CMA architecture are 6AT, 7DCT and 8AT.

If it is the platform architecture of other manufacturers, it usually does not provide so many choices. Needless to say, the driving form must be compatible with the four-wheel drive system.

In fact, in order to realize the diversity of products, CMA architecture divides vehicle components into25 super modulesIn addition to the familiar parts such as engine and gearbox, there are also parts related to body structure and electrification. This is equivalent to playing with permutation and combination. If the number of modules is enough, the more schemes can be pieced together, which can bring different effects to the types and personalities of vehicles.

More importantly, CMA architecture is also compatible with the R&D and production of pure electric vehicles, which is one of the advantages of CMA architecture compared with some other automobile R&D and production architecture platforms.

Speaking of this, I have to mention its high-end electric car brand-Polestar.Polar star.

In Polestar’s product series, there is a very important product, which will be officially introduced to the market this year, that is, Polestar 2, which is a pure electric vehicle aimed at positioning. The pre-sale price announced before is less than 300,000.

This pure electric vehicle is built based on CMA architecture, and it is also the first pure electric vehicle under CMA architecture. However, the pre-production preparation stage of Polestar 2 takes a little longer, and many people can’t wait, so start delivery quickly.

unity

Speaking of diversity, let’s talk about unity. You may feel contradictory. Since there are many kinds, how can we unify them?

Do you still remember that the CMA architecture just mentioned divides the vehicle parts into 25 super modules? These different modules are combined together through a unified interface. The CMA architecture also has a standardized manufacturing process list, which can effectively control different models to adopt the same manufacturing processes and standards in different production lines, thus ensuring the uniformity of vehicle quality.

This can also be found in the actual experience. Although the models born on the CMA architecture have different personalities, they are relatively consistent in some aspects of experience.

Such as sitting posture.

Although SUVs and cars are born with different ride heights, due to the existence of modularity, the bending angles of the upper and lower limbs of the body and the relative positions with the steering wheel and pedals can be unified, so that drivers can find familiar feelings when driving different models of CMA architecture.

The adjustment range of the seat has a standard range, which is 262.2mm in front and back, and 65mm in height. Even in the seat adjustmentNVHOn the other hand, CMA architecture also has its own higher requirements. Their standard is that the maximum sound of seat operation is only 38dB, which is much lower than the mainstream 45dB.

There is also the NVH performance of driving. Although different models will be adjusted in different orientations according to their positioning, the CMA-based models have a very good foundation in the performance of vibration filtering and quietness. Even a car with a 20-inch rim like the 05 is inherently unfavorable to the handling of road shattering, but it still has a very stable performance on the "Belgian Road".

One of the advantages brought by uniformity is the improvement of the universality of parts, which is of great help to reduce the cost of research and development and production.

In fact, the theory that modular platforms or architectures can reduce costs has appeared since MQB platform, but on some platforms or architectures of MQB and other brands, as consumers, it seems that they can’t see what benefits the manufacturers have brought to consumers by reducing costs. First, the quality of cars may not be improved, and second, the price may not be cheaper than before.

However, in the models developed by the brand and even some brands using CMA architecture, we have seen the benefits brought by the manufacturer to consumers by reducing costs, that is, giving consideration to quality and beautiful price.

It’s just that Rut Jun thinks this is also due to the market structure, especially as such an emerging brand, we can see that their products do have advantages in quality and deserve higher prices. However, once the price is high, consumers are less willing to buy new cars. After all, the reality is cruel.

forward looking

As a rising star in automobile R&D and production infrastructure, CMA can show more excellent forward-looking in some details.

Today’s cars, even if they are not pure electric vehicles with new energy, have become more and more complicated in the electrical system, because today’s cars are emphasizing intelligence. An important step to realize the intelligentization of automobiles is to move towards the goal of unmanned driving or autonomous driving. What is the biggest obstacle in front of unmanned driving or autonomous driving?

The answer isarithmetic speed.

In order to achieve higher operation speed, the requirements for vehicle electronic system are higher.

CMA architecture also noticed this at the beginning of development, so it designed electrical system redundancy that can easily cope with the next 10-15 years. At present, the field of intelligent driving is developing very fast, so it was prepared for the intelligent development in the next 15-20 years in the development stage five years ago, which fully reflects the forward-looking nature of CMA architecture.

The forward-looking of CMA architecture is also reflected inCompatibility of power systemIn fact, as we just said, CMA architecture not only has gasoline vehicles, but the 2.0T engine can not only easily meet the stringent national 6 emission standards at this stage, but also be able to cope with the abnormal European 7 emission standards.

In addition, CMA architecture will also have plug-in, light-mixing, and pure electric vehicles.

You may ask, pure electric vehicles and traditional fuel vehicles share the platform architecture, so will this basic pure electric vehicle be a magic work of "changing oil into electricity"? This question does exist, just like everyone’s question about not developing a platform architecture for pure electric vehicles alone.

Rut Jun believes that it depends on whether the platform architecture has considered the R&D and production of pure electric vehicles at the beginning of development. The "oil-to-electricity" we say refers to those platforms that originally only had oil vehicles, but later abruptly added pure electric vehicles. For example, the CMA architecture has included the pure electric power form into the development goal at the beginning of development, which does not belong to "oil to electricity".

Playability

For some people who love cars and cars, they often take playability into consideration when choosing models, and playability may be part of the current lack or limitation of CMA architecture.

The so-called playability mainly refers to the "tossing space" left by the vehicle to the owner.

For example, the MQB platform is probably one of the architecture platforms with strong playability at present. One of the major reasons is that there are already many models born on the MQB platform, and they also have a large number in the market. Then many automotive aftermarket brands will launch modified and upgraded products for MQB platform models. These modifications and upgrades usually include power, chassis and other parts of the kit, and can even be divided into several levels, which is what we often call "first-order".

The CMA architecture is not so mature in this respect. The main reason is that the CMA architecture is still in the process of development and growth, and its ownership is not large enough. Moreover, the previous CMA architecture models did not focus on attracting consumers who love to play with cars.

One of the phenomena of its products can illustrate this point: 03+, as the first China performance car, does have a good foundation in itself, but Rut Jun learned from some channels that the entry-level upgrade scheme commonly used by car players is not feasible at all on 03+.Brush ECU.

Perhaps the technology derived from it has a high level of safety protection, so it is impossible to crack the ECU engine control computer, and the power curve can only be changed through the external computer, and this form of upgrade is very limited for 03+. This hardly leaves the so-called "tossing space" for car users.

At the same time, due to the relatively small demand, 03+ and even other CMA-based models are also very limited in the selection of chassis upgrades.

Golf on the MQB platform, such as Bilstein, SACHS, Tein, Eibach and KYB, can provide countless choices and have a huge modified ecosystem, while CMA 03 can’t find mass-produced big brand modified parts, and there is almost no ecosystem.

In view of the fact that the brands that occupy a big position in the CMA architecture are mainly young consumers, and may have certain needs in changing cars, Rutjun thinks that expanding the playability of CMA architecture is-the next thing to be promoted. After all, cars like 03+ have been built, and the owners have to toss and turn.

Write it at the end

As a modular architecture jointly developed by and, the models born on the basis of CMA can bring consumers a good sense of quality whether driving or riding, especially in some models of brands and brands, and it is really exciting to create a leapfrog driving experience at a price that most consumers are more acceptable.

This has something to do with many goals and standards set by CMA architecture at the beginning of its development. But then again, although there are many models of CMA architecture, compared with the platform architecture introduced by other manufacturers relatively early, the volume is still relatively small. By enriching the product line and expanding the quantity, we can further exert the advantages of modular architecture.

The question is, what kind of products should we continue to launch next to attract consumers? There are many kinds of SUVs, so is there any chance in the car market? Can pure electric vehicle products be decentralized to brands or even brands?

Yu Chengdong: Huawei’s smart driving is spot, not futures

Pacific science and technology informationAt the Huawei HarmonyOS Eco-Spring Communication Meeting held today, Yu Chengdong, managing director of Huawei, CEO of BG and chairman of BU, a smart car solution, said that "Huawei Smart Drive is a spot, not a futures, but the best spot", which triggered a heated discussion among netizens.

It is understood that Huawei’s advanced intelligent driving has been tested and applied in some cities and scenes, such as urban roads, highways and parks. It is equipped with the M5, M7, M9 and S7. It can realize Huawei ADS high-order intelligent driving assistance without relying on high-precision maps. In the future, with the continuous progress of technology and the gradual improvement of regulations, Huawei’s advanced intelligent driving is expected to be applied and promoted in a wider range of fields and scenarios.

Huawei’s advanced intelligent driving is a very advanced and potential automatic driving technology. However, the current automatic driving laws are not perfect, and the automatic driving algorithm still needs further iteration. The public still needs to treat it rationally and choose and use it carefully when facing the intelligent driving function of the car factory.

Industry depth! The article takes you to know in detail the market scale, competition pattern and development prospect of artificial intelligence industry in China in 2021.

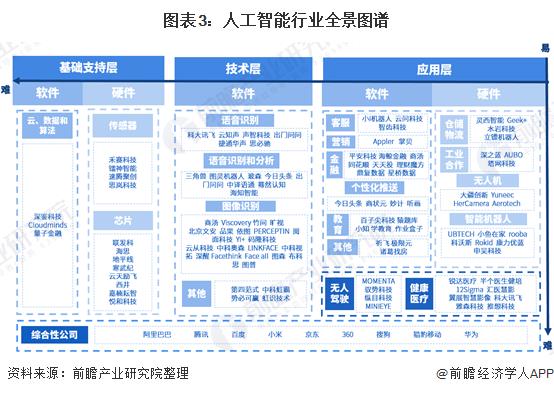

Major listed companies in artificial intelligence industry:At present, the listed companies in the domestic artificial intelligence industry mainly include BAIDU, TCTZF, BABA and (002230).

Core data of this article:Classification of artificial intelligence, industrial chain of artificial intelligence industry, panoramic atlas of artificial intelligence industry, development course of artificial intelligence industry in China, changes in key directions of artificial intelligence industry, distribution of core technologies of industrial intelligence enterprises, scale of artificial intelligence market in China, application share of artificial intelligence market in China, application of artificial intelligence in various industries, investment and financing of artificial intelligence industry in China, distribution of investment and financing rounds of artificial intelligence industry in China, Supply and demand of talents in various technical directions of artificial intelligence, list of new professional universities of artificial intelligence, urban competitiveness of artificial industry in China, representative enterprise areas of industrial intelligence industry, regional distribution of investment and financing events in artificial intelligence industry in China, competitive factions of artificial intelligence industry in China, development trend of artificial intelligence, scale prediction of artificial intelligence industry in China, number of new generation artificial intelligence innovation and development zones in China.

1. Overview of artificial intelligence industry

— — Definition and classification of artificial intelligence

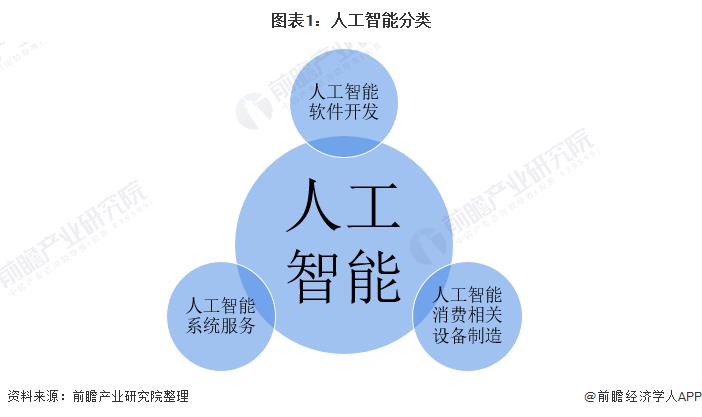

As a cutting-edge interdisciplinary subject, artificial intelligence is a new technical science that studies and develops theories, methods, technologies and application systems for simulating, extending and expanding human intelligence. It is regarded as a branch of computer science, and its research includes language recognition, image recognition, natural language processing and expert system.

The artificial intelligence industry belongs to a strategic emerging industry. According to the Catalogue of Key Products and Services of Strategic Emerging Industries (2016) issued by the National Development and Reform Commission, China’s artificial intelligence can be divided into three subordinate industries, namely, artificial intelligence software development, artificial intelligence consumption-related equipment manufacturing and artificial intelligence system services.

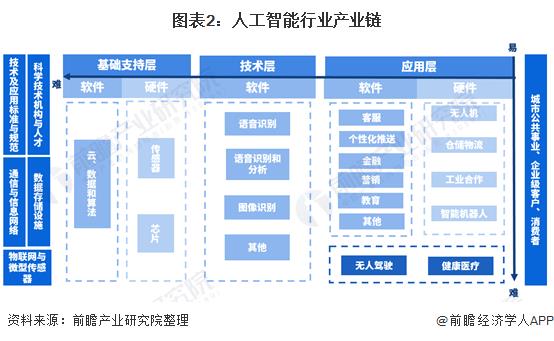

2) Analysis of the industrial chain of artificial intelligence industry: The industrial chain covers a huge industry.

The industrial chain of artificial intelligence includes three layers: basic layer, technical layer and application layer. Among them, the basic layer is the foundation of the artificial intelligence industry, mainly including hardware facilities such as AI chips and infrastructure and data resources of service platforms such as cloud computing, providing data services and computing support for artificial intelligence; The technology layer is the core of the artificial intelligence industry, and the technology path is constructed based on simulating the relevant characteristics of human intelligence. Application layer is an extension of artificial intelligence industry, which integrates one or more basic application technologies of artificial intelligence and forms software and hardware products or solutions for specific application scenarios.

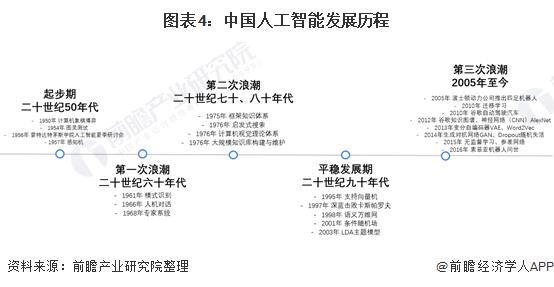

2. The development course of artificial intelligence industry in China: the industry is in the stage of rapid development.

The concept of artificial intelligence was put forward at Dartmouth Conference in 1956. Artificial intelligence has a history of more than 60 years, and has experienced three waves of development since its birth. They are 1956-1970, 1980-1990 and 2000 to the present.

In 1959, Arthur Samuel proposed machine learning, which pushed artificial intelligence into the first development climax. Since then, expert system has appeared in the late 1970s, which indicates that artificial intelligence has moved from theoretical research to practical application.

From 1980s to 1990s, artificial intelligence entered the second development climax with the support of American and Japanese projects. During this period, a series of major breakthroughs were made in mathematical models related to artificial intelligence, such as the famous multi-layer neural network and BP back propagation algorithm, and the accuracy of the algorithm model and expert system were further improved. During this period, the researchers specially designed LISP language and LISP computer, which eventually failed due to high cost and difficult maintenance. In 1997, IBM Deep Blue defeated Garry Kasparov, the world champion of chess, which was a landmark event.

At present, artificial intelligence is in the third development climax, benefiting from the common progress in algorithm, data and computing power. In 2006, Professor Hinton of Canada put forward the concept of deep learning, which greatly developed the artificial neural network algorithm and improved the ability of machine self-learning. Then, the breakthrough of algorithm research represented by deep learning and reinforcement learning, and the continuous optimization of algorithm model greatly improved the accuracy of artificial intelligence applications, such as speech recognition and image recognition. With the popularity of Internet and mobile internet, the global network data volume has increased dramatically, which provides a good soil for the great development of artificial intelligence. The rapid development of information technology such as big data and cloud computing, and the application of various artificial intelligence special computing chips such as GPU, NPU and FPGA have greatly improved the computing ability of machines to handle massive videos and images. With the improvement of algorithm, computing power and data ability, artificial intelligence technology has developed rapidly.

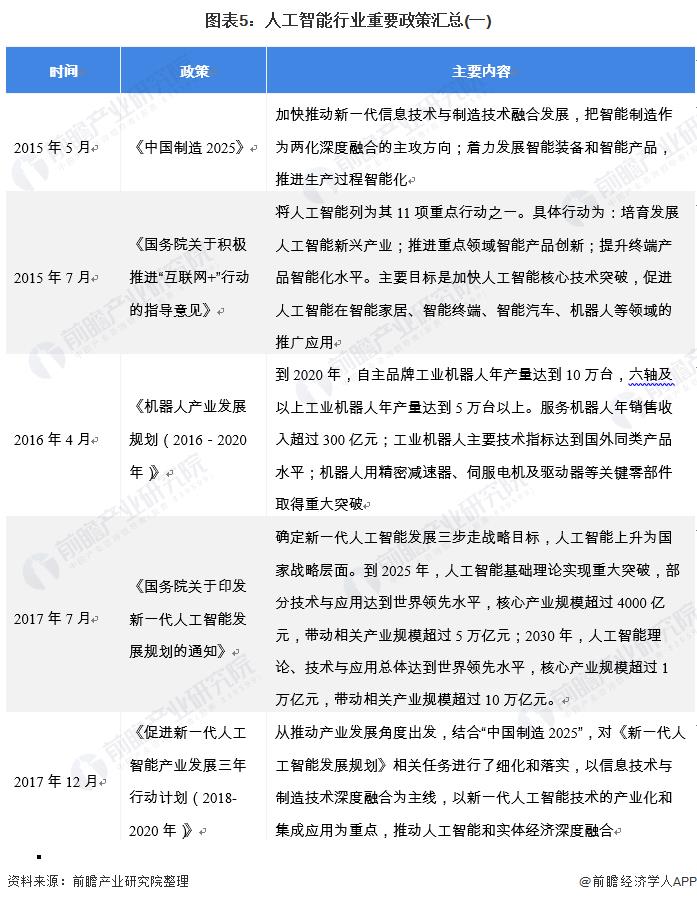

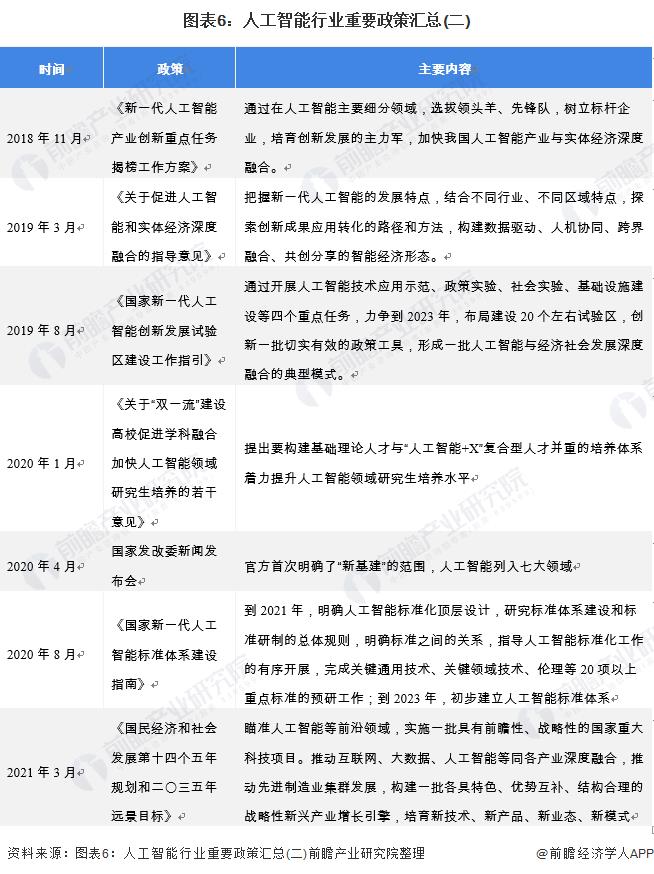

3. Policy background of artificial intelligence industry in China: the industry development has changed from technology to industrial integration.

Before 2017, policies related to artificial intelligence mainly focused on breakthroughs in research and development of artificial intelligence technology. Since 2017, the focus of the policy has shifted from artificial intelligence technology to deep integration of technology and industry. In particular, the "New Generation Artificial Intelligence Development Plan" issued by the State Council in July 2017 clearly pointed out that it is necessary to "accelerate the deep application of artificial intelligence".

From the incomplete summary of the speeches of the two sessions in 2018, it can be seen that the integration of artificial intelligence and industry will be the focus in the future, including official departments such as the Ministry of Science and Technology, the Ministry of Industry and Information Technology, and the Ministry of Civil Affairs, as well as folk representatives such as Baidu, Tencent, and Lenovo, all of which have proposed artificial intelligence+industry, artificial intelligence+medical care, etc.

In 2019, the two sessions even wrote "smart+"into the government work report, and artificial intelligence technology was given the highest level of expectation for the empowerment of society. In the critical period when the industrial economy is changing from quantity and scale expansion to quality and efficiency improvement, the concept of "intelligence+"provides the broadest landing space and return imagination for digital technologies such as artificial intelligence. Opening up the whole chain elements of traditional industrial production through intelligent means can better promote the digitalization, networking and intelligent transformation of manufacturing industry, and can also reverse the iteration and progress of technology itself.

In 2020, it will be clear that artificial intelligence is an important part of the construction of "new infrastructure", and the "Fourteenth Five-Year Plan" points out that it is necessary to promote the deep integration of the Internet, big data and artificial intelligence. And provinces and cities are also vigorously promoting the integration of artificial intelligence and industry, creating application scenarios and demonstration projects.

4. Analysis of the development status of artificial intelligence industry in China.

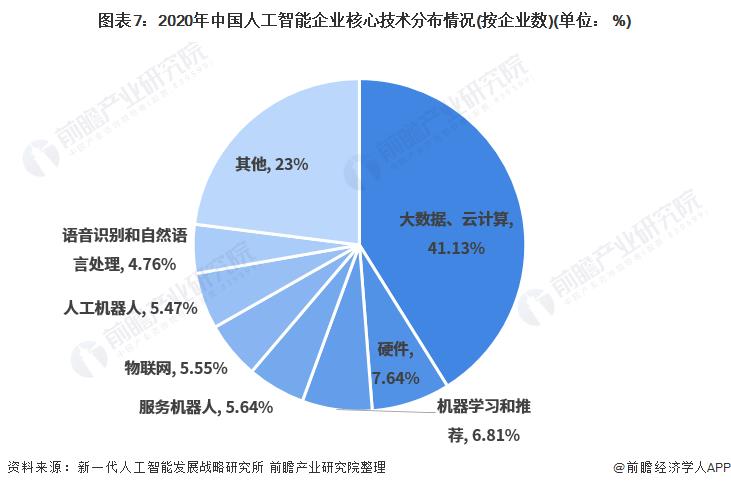

— — Big data and cloud computing are the core technologies with the highest proportion.

From the distribution of core technologies of artificial intelligence enterprises, big data and cloud computing accounted for the highest proportion, reaching 41.13%; Followed by hardware, machine learning, recommendation and service, accounting for 7.64%, 6.81% and 5.64% respectively; Internet of Things, industrial robots, speech recognition and natural language processing accounted for 5.55%, 5.47% and 4.76% respectively.

2) China’s artificial intelligence industry shows a rapid growth trend.

In July, 2017, the State Council issued the "New Generation Artificial Intelligence Development Plan", which raised artificial intelligence to the national strategic level. Thanks to the strong support of national policies and the drive of capital and talents, the development of China’s artificial intelligence industry is at the forefront of the world. It is preliminarily estimated that the market size of artificial intelligence industry in China will be about 185.82 billion yuan in 2020.

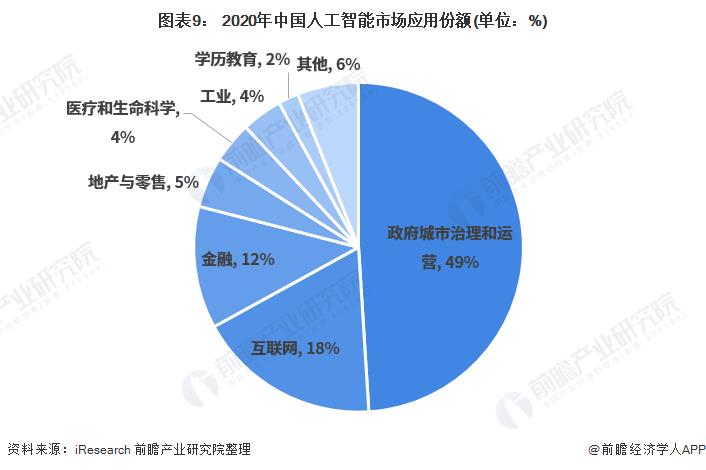

3) The downstream application of artificial intelligence in China mainly focuses on government urban governance and operation.

In 2020, the main customers of China’s artificial intelligence market will come from government urban governance and operation (public security, traffic police, justice, urban operation, government affairs, transportation management, land and resources, prisons, environmental protection, etc.), with applications accounting for 49%, followed by the Internet and financial industries, accounting for 18% and 12% respectively.

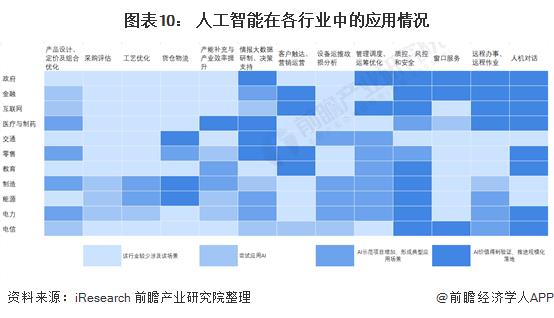

The application of artificial intelligence by enterprises and governments is gradually heating up. Artificial intelligence can be seen in every link that determines the economic benefits of enterprises: AI core helps people live safely, trade remotely and pass easily; Deep learning and knowledge map help enterprises to analyze, predict and make scientific decisions in the production process; Man-machine dialogue improves the user experience in visit registration and service response.

Artificial intelligence will give birth to new technologies, new products, new formats and new models, realize the overall leap of social productivity and push the society into the era of intelligent economy. According to a forward-looking estimate, at present, most large enterprises in China have been planning and investing in artificial intelligence projects continuously, and more than 10% of all enterprises have combined artificial intelligence with their main business to improve their industrial status or optimize their operating efficiency.

4) Capital is more inclined to the early investment of artificial intelligence enterprises

From 2014 to 2020, there were 4,796 investment and financing events in the artificial intelligence industry in China, with a total financing amount of 768.539 billion yuan. In 2014-2018, the financing events and financing scale showed a continuous growth trend. In 2018, the financing amount reached 148.246 billion yuan, and there were 965 financing events.

From 2019 to 2020, the market of China’s artificial intelligence industry is much calmer than before, and the financing events have declined but the financing scale has increased. In 2020, there were 723 investment and financing incidents in China’s artificial intelligence industry with a total amount of 146.837 billion yuan. From January to July, 2021, there were 506 financing events, and the financing amount reached 183.992 billion yuan, which has exceeded the total amount in 2020.

Note: The data of 2021 is as of July 27th.

Judging from the distribution of financing rounds in China’s artificial intelligence industry, because the financing amount and valuation of start-up enterprises are relatively reasonable and the bubble is small, the capital is more inclined to the early investment of artificial intelligence enterprises. From 2014 to 2019, the angel round and A round in the artificial intelligence industry accounted for the highest proportion.

With the gradual maturity of the artificial intelligence market segment, the proportion of early investment gradually decreased, and the investment rounds of artificial intelligence gradually moved back. In 2020, the proportion of Round A will be 42.20%, Round B will rise to 20.22%, and the proportion of Angel Wheel will drop to 9.23%.

Note: The data of 2021 is as of July 27th.

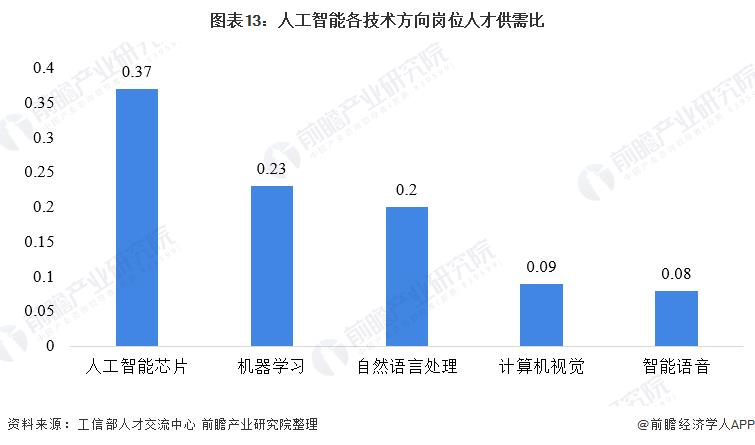

5) There is a shortage of talents in artificial intelligence technology in China, and colleges and universities offer related majors.

According to the relevant data released by the Ministry of Industry and Information Technology, the ratio of supply and demand of talents in different technical directions of artificial intelligence is lower than 0.4, indicating that the supply of talents in this technical direction is seriously insufficient. From the perspective of sub-industries, the supply-demand ratio of post talents for intelligent voice and computer vision is 0.08 and 0.09 respectively, and relevant talents are extremely scarce.

Note: the ratio of supply and demand of post talents = the number of talents who intend to enter the post/the number of posts.

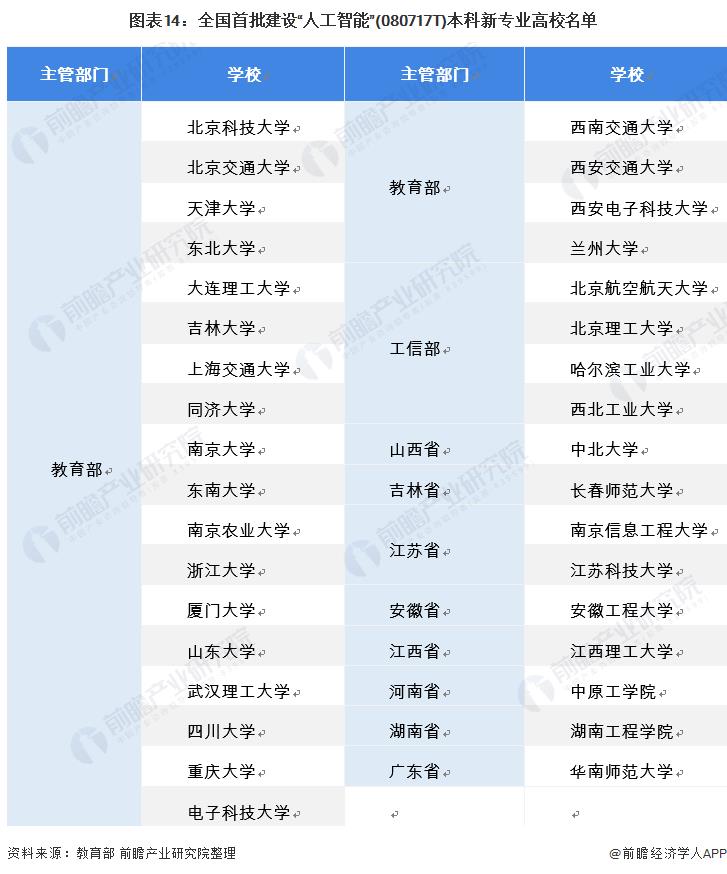

Compared with foreign countries, the cultivation of artificial intelligence in colleges and universities in China started late, but in recent years, the disciplines and majors of artificial intelligence in China have been accelerated, and a multi-level artificial intelligence talent training system has gradually formed. In April 2018, the Action Plan for Artificial Intelligence Innovation in Colleges and Universities issued by the Ministry of Education proposed that 50 artificial intelligence colleges, research institutes or interdisciplinary research centers should be established by 2020.

In 2019, the Ministry of Education issued the "Notice of the Ministry of Education on Announcing the Record and Approval Results of Undergraduate Majors in Ordinary Colleges and Universities in 2018". A total of 35 colleges and universities across the country were awarded the first batch of qualifications for building "artificial intelligence" undergraduate majors.

5. Analysis of the competitive pattern of artificial intelligence industry in China.

— — Regional competition pattern: Beijing’s artificial intelligence competitiveness is far ahead.

Since 1990, the urban pattern of the development of artificial intelligence industry in China has changed several times. At present, Beijing, Shanghai, Shenzhen, Hangzhou and other cities are performing stably. These cities regard electronic information industry as one of the pillar industries and rank high in the development of Internet industry. These cities all strengthen the advantages of scientific research and talents, accelerate the supplement and improvement of artificial intelligence itself and industry-oriented industrial chain, build demonstration intelligent application scenarios, forward-looking layout of artificial intelligence-related standard systems, promote the sharing of public resources, improve urban environment and livability, and support systematic and advanced R&D layout, which will become the planning direction for cities to grasp the great historical opportunity of artificial intelligence development.

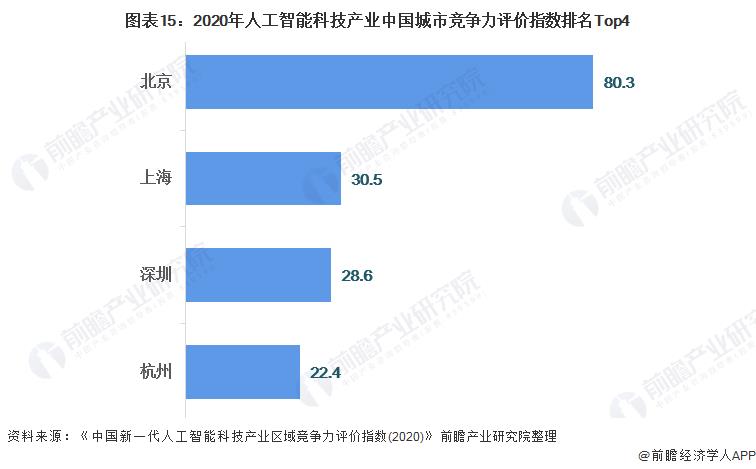

Among them, Beijing is far ahead of other cities in the ranking of competitiveness evaluation index of artificial industry cities in China with 80.3. The second-ranked Shanghai index is 30.5, followed by Shenzhen and Hangzhou with 28.6 and 22.4 respectively.

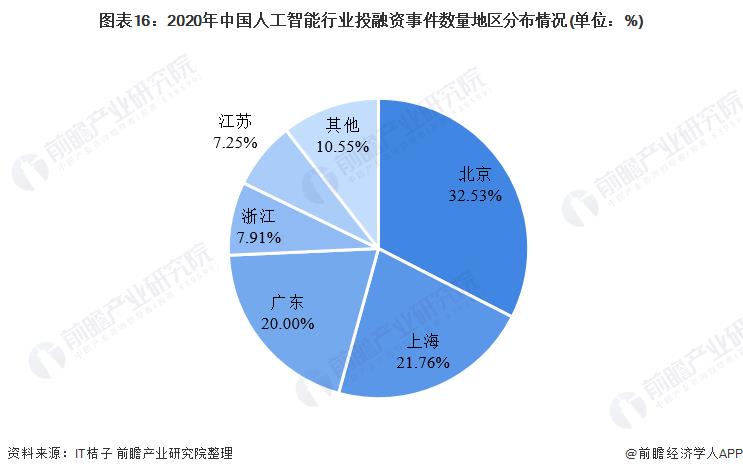

Judging from the territorial distribution of representative enterprises in the artificial intelligence industry, Beijing and Shenzhen are the concentrated places of representative enterprises in artificial intelligence. At the same time, Beijing is also the region with the largest number of investment and financing events in the artificial intelligence industry in 2020. In 2020, Beijing, Shanghai and Guangdong gathered 74.29% of the national AI investment and financing events, of which Beijing accounted for 32.53%, Shanghai for 21.76% and Guangdong for 20%. Zhejiang and Jiangsu followed closely, accounting for 7.91% and 7.25% respectively.

In terms of urban strongholds, four domestic first-tier cities, namely, Beijing, Shenzhen, Shanghai and Hangzhou, have become the focal points for the development of China’s artificial intelligence industry, promoting the rise of artificial intelligence technology in Beijing-Tianjin-Hebei Development Zone, Guangdong-Hong Kong-Macao Greater Bay Area and Yangtze River Delta Economic Zone, and covering the whole country.

2) Enterprise competition pattern: There are many participants, mainly divided into three factions.

Judging from the competition of enterprises, China’s artificial intelligence enterprises can be mainly divided into three factions, namely, head platform representative enterprises, integrated industry active enterprises and technical level representative enterprises.

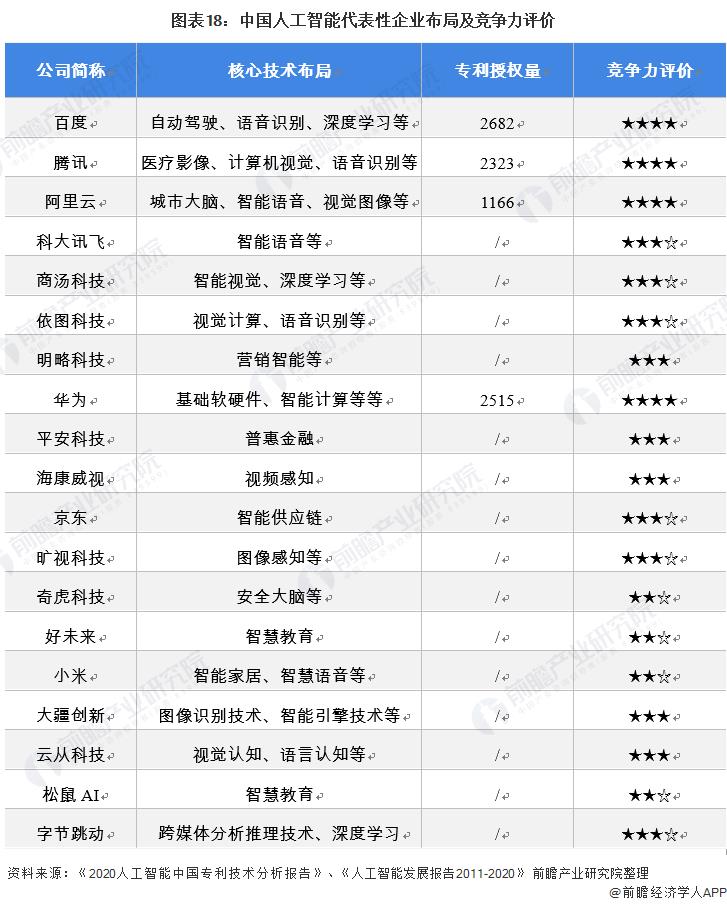

The representative enterprises of artificial intelligence platform mainly include Baidu, Alibaba Cloud, Tencent, Huawei, JD.COM and Huawei; Xiaomi, Ping An Technology, Suning and Didi are more active enterprises in the integration industry; Representatives of technical enterprises include Shangtang Technology, Defiance Technology, Yuncong Technology and Yitu Technology as unicorn companies.

Judging from the core technology layout of artificial intelligence enterprises, Baidu, Tencent, Alibaba Cloud, Huawei and other head platform enterprises have laid out a number of AI technologies; However, converged companies such as Ping An Technology, JD.COM, Xiaomi, etc., their technical layout is mainly aimed at the application layer, with strong pertinence.

Judging from the number of patents granted, as of October 2020, Baidu, Huawei and Tencent ranked the top three in the country respectively, indicating that these three companies have strong technology research and development capabilities.

6. Development prospect and trend forecast of artificial intelligence industry in China.

— — The "Tenth Five-Year Plan" construction continued to advance, with high quality, modernization and intelligent development.

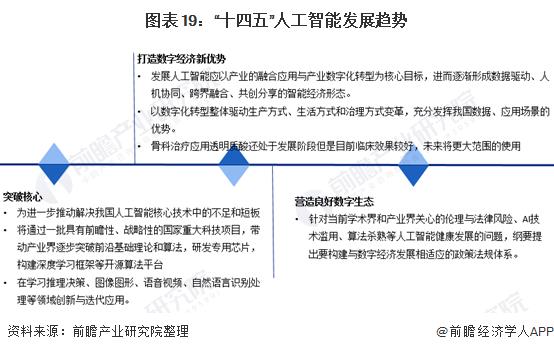

In recent years, artificial intelligence has had a significant and far-reaching impact on economic development, social progress and international political and economic structure. The 14th Five-Year Plan for National Economic and Social Development in People’s Republic of China (PRC) and the Outline of Long-term Goals in 2035 have made arrangements for the development goals, core technological breakthroughs, intelligent transformation and application, and safeguard measures of artificial intelligence in China during the 14th Five-Year Plan and the next decade.

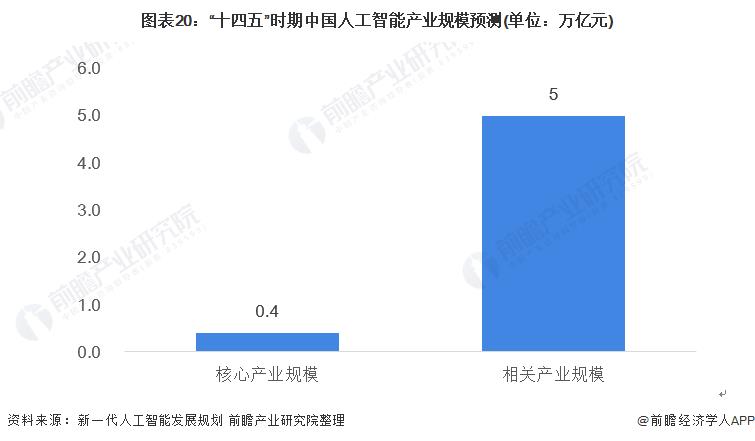

2) The scale of artificial intelligence core industry in China has reached 400 billion, and 20 experimental areas have been laid out.

According to the "New Generation Artificial Intelligence Development Plan", by 2025, China’s basic theory of artificial intelligence has achieved a major breakthrough, and some technologies and applications have reached the world’s leading level. Artificial intelligence has become the main driving force for China’s industrial upgrading and economic transformation, and the construction of intelligent society has made positive progress. The scale of artificial intelligence core industries will exceed 400 billion yuan, driving the scale of related industries to exceed 5 trillion yuan; By 2030, China’s artificial intelligence theory, technology and application will reach the world’s leading level.

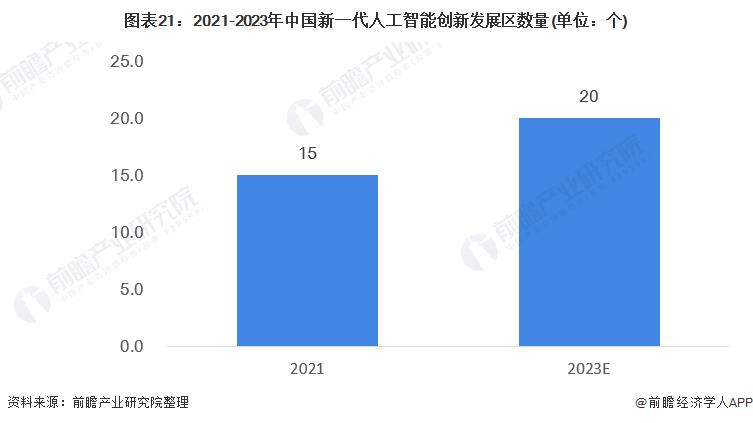

In addition, in order to speed up the implementation of the "Notice of the State Council on Printing and Distributing the Development Plan of the New Generation Artificial Intelligence", the Ministry of Science and Technology issued the "Guidelines for the Construction of the National New Generation Artificial Intelligence Innovation and Development Experimental Zone" in August 2019, aiming at promoting the construction of the National New Generation Artificial Intelligence Innovation and Development Experimental Zone in an orderly manner. By the end of March 2021, 14 cities and 1 county in China had been approved to build the experimental area; By 2023, the number of experimental areas is expected to reach about 20.

Please refer to Foresight Industry Research Institute for the above data and analysis. At the same time, Foresight Industry Research Institute also provides solutions such as industrial big data, industrial research, industrial chain consultation, industrial map, industrial planning, park planning, industrial investment attraction, IPO fundraising feasibility study, IPO business and technology writing, and IPO working paper consultation.

Xiaomi car, not enough "millet"

ChatRoads

Look with your heart and talk seriously-

On December 28th, Xiaomi Automobile Technology Conference was held in the National Convention Center, which officially revealed the progress and breakthrough of five core technologies of Xiaomi Automobile, and ushered in the first appearance of Xiaomi SU7, the first product of the platform. The design, performance, battery life, safety and other details of SU7 were made public for the first time. Next, let’s briefly understand the core technology of the big show at the meeting and the details of Xiaomi SU7, and finally we will analyze and summarize it.

01

Release of five core technologies

At this conference, Lei Jun mainly introduced the five core technologies of Xiaomi Automobile: electric drive, battery, large die casting, intelligent cockpit and intelligent driving.

01

Xiaomi "super motor"

The speed of V6 and V6s which have been mass-produced is 21,000 rpm. Among them, the V6 super motor has a maximum power of 220kW and a peak torque of 400N·m, and is built with a 400V architecture. The V6s super motor has a maximum power of 275kW and a peak torque of 500N·m, and is built with 800V architecture. As for the V8s, which has not been mass-produced, the speed is as high as 27,200 rpm, which is the first in the industry from the data point of view, but it will not be available until 2025.

02

CTB integrated battery technology

The integrated efficiency of CTB integrated battery of Xiaomi Automobile reached 77.8%, which increased by 24.4% and released the height of 17 mm.. At the same time, the full-stack self-developed battery management system equipped with ASIL-D’s highest functional safety level can collect data in real time, encrypt the cloud through the private network for analysis and early warning, and realize active power failure within 4ms when necessary.

03

9100t Super Die Casting

The mold force reaches 9100t, and Xiaomi’s self-developed visual large model quality judgment system can complete the inspection within 2 seconds, with 10 times higher efficiency than manual work and 5 times higher precision than elite. With the application of this technology, 72 parts of the back floor of Xiaomi automobile are integrated, 840 solder joints are reduced, the overall weight is reduced by 17%, and the production hours are greatly reduced by 45%. In terms of material research and development, Xiaomi has developed a high strength, high toughness and heat-free environmental protection die-casting material "Titan alloy".

04

Full-stack self-developed intelligent driving technology

The industry’s first three key technologies, namely, adaptive zoom BEV technology, large road model and super-resolution occupation network technology, can be combined with the large air-to-end perception decision model, and can accurately park in the 0.05m mechanical garage. Lei Jun said that it is estimated that more than 100 cities can start urban assisted driving by the end of 2024.

05

"People-centered" Intelligent Cockpit

1.49S starts at top speed, the cockpit system is upgraded for 3 minutes, and the whole vehicle is upgraded for 30 minutes. It has a strong ecology, deeply adapts to mainstream applications, and more than 5,000 applications get on the bus. Moreover, the mobile phone X car is interconnected and connected across terminals, and the mobile phone application PIN is put on the car anytime and anywhere, and the car machine is native in seconds. In addition, the huge hardware ecology, the mijia equipment, and no feeling of getting on the bus. Car IOT hardware ecology is fully open to the public and freely develops various applications.

02

Xiaomi SU7 has bright parameters.

With the blessing of five core technologies, the core competitiveness of SU7 has the following points:

01

The maximum power is 495kW, the acceleration time is 2.78 seconds per 100 km, the braking distance is 33.3m per 100 km, and the maximum speed can reach 265 km/h, which exceeds Taycan Turbo and Model S.

02

CLTC has a mileage of 800 kilometers, and supports 800V super fast charging, supporting 200 kilometers battery life in 5 minutes and 510 kilometers battery life in 15 minutes.

.

03

The car is equipped with five screens, including a 16.1-inch central control screen, a 56-inch HUD, a 7.1-inch instrument panel and two millet tablets in the rear seat. The car machine uses the latest 8295 car and chips and the 澎湃 OS interactive system, which can make the car machine of Xiaomi SU7 highly integrated with Xiaomi mobile devices and even intelligent furniture, and the accounts can be interoperable, so applications can be directly used on the car.

04

Full-stack self-developed intelligent technology and self-developed sensing technology, self-developed adaptive zoom BEV technology, large road model and super-resolution network technology are adopted to achieve a comprehensive leap in visibility accuracy, sensing accuracy and control accuracy.

05

The length, width and height of Xiaomi SU7 are 4997/1963/1440mm and the wheelbase is 3000mm. The drag coefficient of Xiaomi SU7 is only 0.195Cd, which is the lowest in the world.

06

The super-large die casting technology adopted has 90.1% high-strength steel and aluminum alloy, the highest strength of 2000MPa and the torsional stiffness of 51000 N m/deg.

03

Can we achieve "leapfrogging"?

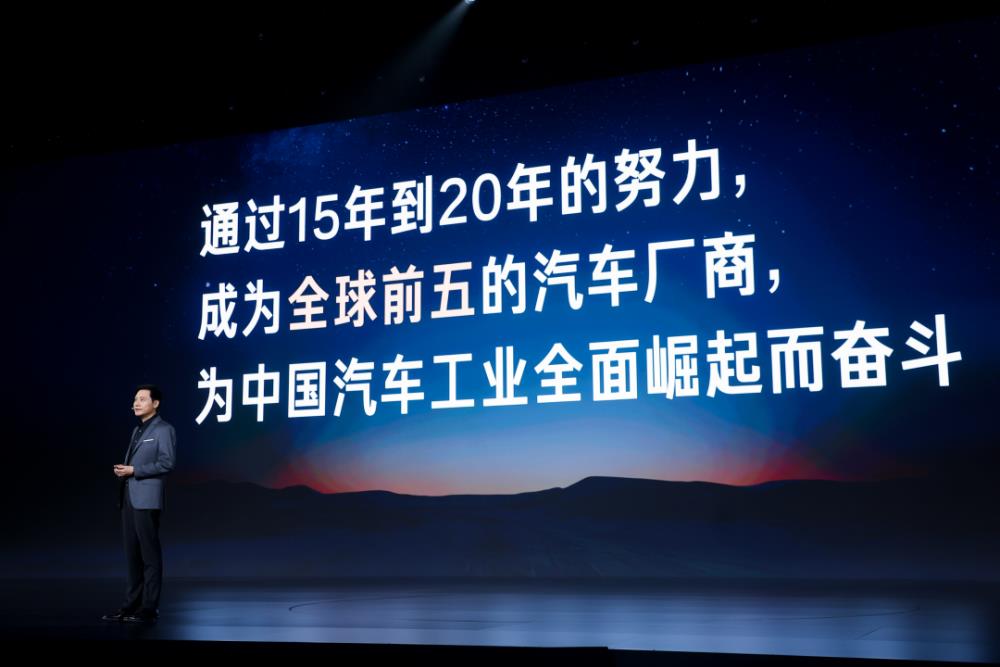

At the meeting, Lei Jun said that he put high demands on the R&D team, and the design goal was to start from 100 "first, only and most", with the goal of building dream cars in a new era of automobile industry, becoming the top five automobile manufacturers in the world in the next 15 to 20 years, and working hard for the overall rise of China automobile industry.

First of all, we can be sure that the technologies released at the Xiaomi conference are not bad, and the Xiaomi SU7 has no obvious shortcomings at present. The explosion potential in terms of flow, product strength and design has been demonstrated, but after careful study, Xiaomi Automobile has no more prominent highlights. Some of the technologies it shows are "far ahead" or "pioneering". In fact, some friends have mass-produced them to real cars and launched them on the market.

For example, Xiaomi Automobile will adopt CTB technology in its battery system. As early as last June, BYD took the lead in releasing CTB technology in the industry and installed it on its BYD Seal model. Although the volume utilization rate of CTB battery released by Xiaomi is higher than that of BYD, the volume utilization rate of 77.8% is not the highest. Previously, the volume utilization rate of the "BRIC battery" released by Extreme Krypton Automobile has reached 83.7%.

Another example is Xiaomi’s 9100t super-large die-casting, with a press of 9100t, but Tucki has already used a press of 12000t, and the largest die-casting machine equipment factory in China is developing a press of 20000t. Therefore, 9100 tons is not leading, only the mainstream.

At the same time, at present, the main product details of Xiaomi SU7 are almost fully disclosed, leaving only the last "card"-price, which is also the most controversial place. At the meeting, after comparing various models, Lei Jun said: "Let’s stop calling 99,000 and 149,000. This is impossible, but we should respect technology." In other words, Xiaomi SU7 is likely to fall in the price range of 200,000-300,000.

But can the price range of 200,000-300,000 coincide with Xiaomi’s existing user base? You know, at the beginning of Xiaomi’s announcement to build a car, most of the voices on the Internet hoped that Xiaomi would knock down the price of the car. This time, the pricing may exceed the budget of most people. More importantly, the price range of 200,000-300,000 is actually the most competitive range of new energy vehicles in China. For consumers who can accept this price range, it is still unknown whether SU7 can meet their demand points, and Xiaomi Automobile currently lacks brand recognition and trust, which can actually give consumers little confidence.

For a long time, Xiaomi has given people the impression that it has amazing hard power and amazing cost performance. But this time, Xiaomi obviously didn’t want to continue to take the civilian route, and changed to a mid-to high-end route. The price exceeded expectations, and the road would naturally be more difficult. In addition to the price, the Xiaomi car that everyone expects unanimously is a model that can come up with some subversive new technologies. However, the actual situation of Xiaomi SU7 seems to be almost interesting, and it seems that people have not been able to see the unique side of Xiaomi.

However, in any case, it is worthy of tribute that Xiaomi Automobile has taken a brave first step seriously. Xiaomi, who has crossed the border to the automobile field, has a lot of core technologies. Starting from the lowest technology, it has spent ten times to build a good car. At the same time, Xiaomi Automobile has natural traffic and user attention, which not only helps to promote healthy competition in the industry, but also is likely to become a key role in leading the next development trend. Finally, let’s look forward to next year, and Xiaomi Auto will bring us more surprises!

[Dancing with the Yangtze River Economic Belt] Huizhou merchants once again monopolized 1/8 of global computer sales.

Hefei export processing zone. (provided by Anhui Netcom Office)

CCTV News (Reporter He Chuan Kong Hua) The Yangtze River flows through the territory of Anhui Province, which is called Wanjiang River. The 800-mile Wanjiang River once gave birth to famous Huizhou merchants at home and abroad. Today, in the Yangtze River Economic Belt, Huizhou merchants are still shining.

On July 1st, an interview group of reporters dancing in the Yangtze River Economic Belt walked into Hefei, the capital of Anhui Province. CCTV reporter learned from Hefei Export Processing Zone that one-eighth of the world’s computer sales come from here.

In Lianbao (Hefei) Industrial Base in Hefei Export Processing Zone, the uniform factory buildings are endless, laptops are filed out at the end of the production line, and thousands of busy front-line industrial workers gather into a landscape.

According to the person in charge of relevant departments of Lianbao (Hefei) Base, Lenovo Group and Taiwan Province Compal Group jointly set up this production base in Hefei Export Processing Zone, which was officially put into production on December 27th, 2012. By 2016, Lianbao (Hefei) Base has become the world’s largest PC manufacturer and Lenovo’s largest production base with an annual output of 30 million units.

The person in charge said: "Lianbao (Hefei) base is the largest industrial enterprise in Hefei and the largest import and export enterprise in Anhui. Products are sold to 5 regions, 13 sub-regions and 126 countries around the world. For every 8 computers sold in the world, one is made by Hefei Lianbao. "

Lianbao (Hefei) base is growing day by day, attracting upstream and downstream supporting enterprises like a magnetic field.

It is understood that in Hefei Export Processing Zone, an electronic information industry cluster led by Lianbao has quietly formed. With the help of the marriage with Lianbao, Hefei Export Processing Zone quickly became the first phalanx of export processing zones in China.

"In 2016, Hefei Export Processing Zone achieved an industrial output value of 43.04 billion yuan above designated size, a total import and export value of 3.62 billion US dollars, and paid various taxes of about 1.7 billion yuan. Among them, the total import and export accounted for 8.1% and 19.2% of the total import and export of the province and the city respectively, ranking sixth in the national export processing zone and second in the central and western regions for three consecutive years, writing a miracle of the development of inland export processing zones. " According to the staff of Hefei Export Processing Zone, Hefei Export Processing Zone has also fully introduced new formats such as bonded display transactions, domestic and foreign maintenance and financial leasing, and successfully built the only "Anhui Province Self-operated Import Direct Selling Center" project in Anhui Province.

It is understood that up to now, the direct selling center of self-operated imported goods in Anhui Province achieved a sales income of 26.41 million yuan in 2016 and completed a first-line self-operated import of 1.359 million US dollars.

In the hinterland of the Yangtze River, the dead are like this. After a hundred years of gorgeous turn, Huizhou merchants have set up the tide of internet economy again, looking around the business community, and their gestures are still shining.