The picture shows Auditor-General Liu Jiayi at the 21st meeting of the 12th the NPC Standing Committee on June 29th.

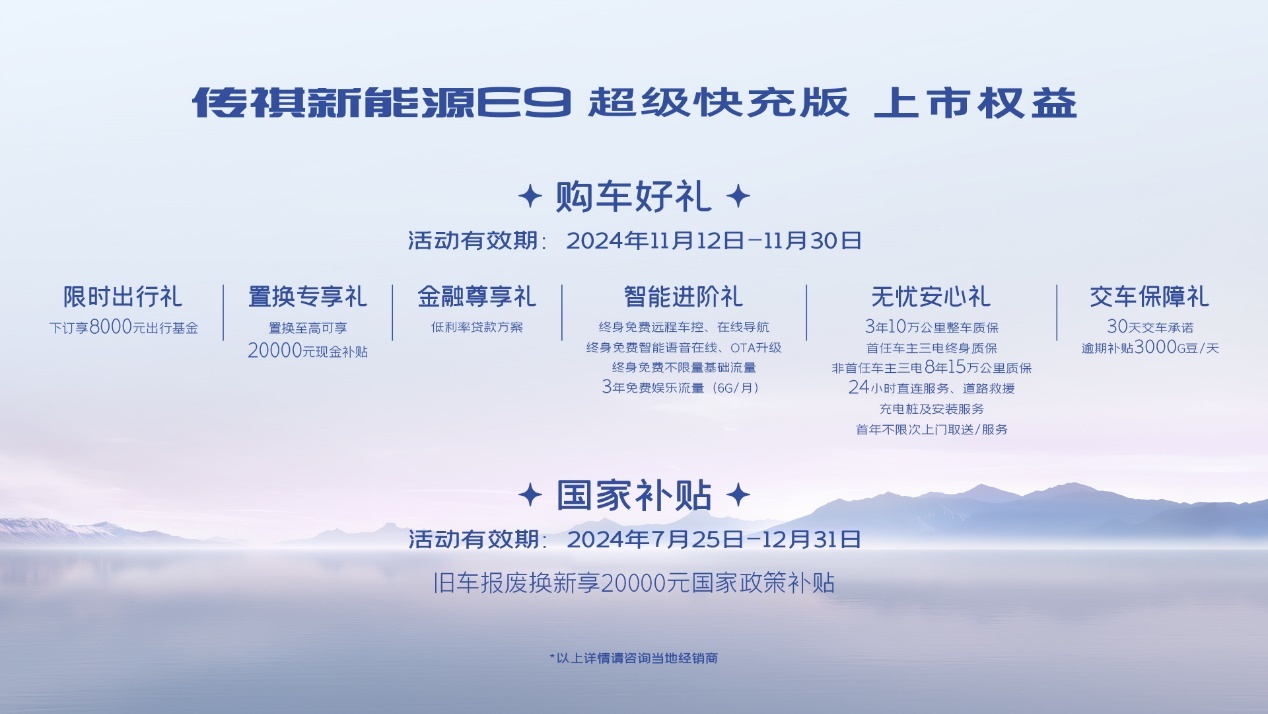

Xinhua News Liu Jiayi, Auditor-General of the National Audit Office, today (June 29th) gave a report on the audit of the implementation of the central budget and other financial revenues and expenditures in 2015 to the 21st session of the 12th the National People’s Congress Standing Committee (NPCSC) (hereinafter referred to as the audit report). The audit report pointed out that in 2015, local government debts of 11 provinces, 10 cities and 21 counties were audited. By the end of 2015, the balance of government debts of 11 provinces was 820.2 billion yuan, and the balance of contingent debts was 1,097 billion yuan.

The audit report pointed out that some areas still violate the rules or borrow in disguise. Spot checks show that by the end of 2015, four provinces, including Zhejiang, Sichuan, Shandong and Henan, had a debt balance of 15.35 billion yuan through illegal guarantees, fund-raising or promised repayment.

The audit found that some hidden debts appeared in some places. Four provinces, including Inner Mongolia, Shandong, Hunan and Henan, agreed to pay the construction funds in the name of government purchasing services in the entrusted construction projects, involving financing of 17.565 billion yuan; Among the 23.594 billion yuan of funds raised by the four provinces of Zhejiang, Henan, Hunan and Heilongjiang in infrastructure construction, there are different degrees of government commitments to buy back social capital and solidify income.

The full text of the report is as follows:

The State Council about2015Annual audit report on the implementation of the central budget and other financial revenues and expenditures

— — At the 21st meeting of the 12th the NPC Standing Committee on June 29th, 2016,

Auditor-General Liu Jiayi

The NPC Standing Committee:

Entrusted by the State Council, I report to the National People’s Congress Standing Committee (NPCSC) on the audit of the implementation of the central budget and other financial revenues and expenditures in 2015, for your consideration.

According to the Audit Law and relevant laws and regulations, the National Audit Office audited the implementation of the central budget and other financial revenues and expenditures in 2015. In accordance with the spirit of the Fifth Plenary Session of the 18th CPC Central Committee and the arrangements of the CPC Central Committee and the State Council on economic work, the audit work focuses on promoting the implementation of major policies and measures, insisting on auditing according to law, being objective and realistic, encouraging innovation, and promoting reform, carefully distinguishing unintentional negligence from knowingly committing crimes, work mistakes from dereliction of duty, exploring practice and abusing power for personal gain, seriously exposing major problems that harm the interests of the masses, violate major disciplines and laws, and fail to perform major duties, and promptly revealing major potential risks. Focusing on structural and institutional issues, it mainly audited the central financial management, budget implementation and final accounts, local government debt, poverty alleviation and other key funds and projects, the implementation of major policy measures, and financial institutions and central enterprises.

In 2015, under the strong leadership of the CPC Central Committee and the State Council, all departments and regions conscientiously implemented the resolutions of the Third Session of the 12th National People’s Congress, actively responded to complex situations, overcame multiple difficulties, and made new achievements in economic construction and social development. Overall, the implementation of the central budget is good.

— — Economic development is progressing steadily, and it is good in stability. Facing the downward pressure of the economy, we innovated the way of regulation and control, accelerated structural adjustment and innovation drive, and promoted regional coordinated development and new urbanization. The GDP increased by 6.9%, and per capita disposable income grew faster than the economic growth rate, with 13.12 million new jobs in cities and towns and 14.42 million rural poor people reduced.

— — A proactive fiscal policy will increase efficiency. Efforts were made to optimize the structure, revitalize the stock, make good use of the increment, increase tax reduction and fee reduction, and expand effective investment. The revenue and expenditure of the central general public budget increased by 7.1% and 8.4% respectively. We will deepen decentralization, combine decentralization with management, optimize service reform, cancel or suspend the collection of 57 central-level administrative fees, and streamline the pre-approval of industrial and commercial registration by 85%.

— — Fiscal and tax reform has been steadily advanced. Study and promote the reform of the division of powers and expenditure responsibilities between the central and local governments, and improve the transfer payment system. We will promote the pilot reform of the camp, expand the scope of ad valorem collection of resource taxes, and all the increase in export tax rebates will be borne by the central government. Establish a standardized local government debt financing mechanism, incorporate debt classification into the budget, and implement quota management.

— — Budget management is constantly standardized. We will promote the implementation of medium-term financial planning management, formulate methods for compiling comprehensive financial reports of the government, improve the system and mechanism of state-owned assets management, and improve the standard of basic expenditure quota and project expenditure management. Strict economy and strict control of general expenditures, the budget of the "three public" funds at the central level decreased by 11.7%.

— — The accountability for rectification was further strengthened. The State Council specially deployed the rectification work of the problems identified in the 2014 annual audit, and included the supervision matters. Relevant departments, units and localities have incorporated the rectification into the special education of "three strictness and three realities", and the Audit Commission has strengthened the follow-up and supervision according to the requirements of the State Council, and the rectification effect has been the best over the years. In December 2015, the National People’s Congress Standing Committee (NPCSC) listened to the State Council’s report on rectification, and put forward deliberation opinions. Relevant departments, units and localities have earnestly implemented it, further strengthened rectification, conducted in-depth verification, implemented responsibilities and properly disposed of problems left over from history; For institutional problems, we will accelerate reform and improve the system. At present, the basic rectification has been completed, and the promotion of income increase, expenditure reduction and loss recovery has increased to 608.3 billion yuan, and 5,947 systems have been formulated and improved, handling more than 5,500 people.

Judging from this year’s audit, the relevant departments, units and local governments have further enhanced their awareness of financial discipline and deepening reform, and have been able to implement the decision-making arrangements of the CPC Central Committee and the State Council, promote reform and innovation, and significantly improve the level of financial management and the performance of fund use. However, there are still problems of violating discipline and violating the law and irregular management in some areas, especially in some aspects, the institutional mechanisms are not perfect, laws and regulations and operating rules are not adjusted in time, and there are problems such as poor information transmission, insufficient coordination of measures, and unsuitable supervision, which affect the implementation of relevant policies and measures.

I. Audit of the draft central final accounts and budget implementation

(1) Audit of the draft final accounts of the central government. According to the provisions of the Budget Law, the National Audit Office audited the draft final accounts of the central government prepared by the Ministry of Finance before it was submitted to the State Council. The draft final accounts of the central government prepared by the Ministry of Finance shows that the revenue of the central general public budget is 6,926.719 billion yuan and the expenditure is 8,063.966 billion yuan. The revenue of government funds was 411.819 billion yuan and the expenditure was 436.342 billion yuan; The operating income of state-owned capital was 161.306 billion yuan, and the expenditure was 136.257 billion yuan. Compared with the implementation reported to the National People’s Congress, the final accounts of general public budget revenue are 3.32 billion yuan more, and the final accounts of expenditure are 9.034 billion yuan less; The final accounts of government fund income (including local income) are more than 1.229 billion yuan, and the final accounts of expenditure are more than 700 million yuan; The final accounts of state-owned capital operating income are 14 million yuan more, and the final accounts of expenditure are 290 million yuan more. The above-mentioned income and expenditure difference is mainly based on the adjustment made by the cleaning results during the final settlement period. The main problems found in the audit:

1. No changes in budget levels were reported. Including: adjusting the central level expenditure of 10.124 billion yuan to the local transfer payment expenditure, and adjusting the local transfer payment expenditure of 26.252 billion yuan to the central level expenditure. After the audit pointed out, the Ministry of Finance has made a report on the budget level adjustment of major subjects in the draft final accounts.

2. The presentation of some income is not comprehensive enough. Mainly, 93.748 billion yuan of value-added tax and consumption tax has been refunded to software and resources comprehensive utilization enterprises according to regulations, which is not reflected in the draft final accounts. After the audit pointed out, the Ministry of Finance has added supplementary explanations to the draft final accounts.

3. According to the facts, the settlement matters are not standardized. Mainly because the scope and standards of application are not clear, some liquidation periods are too long or the liquidation is not timely, and some use the funds over-allocated in the previous year to offset the expenditures of the current year. For example, in 2015, the agricultural and forestry insurance premium subsidies of 2.52 billion yuan over-allocated in the previous year were directly used to offset the expenditures that should be arranged in the current year.

4. Failing to report the performance of financial funds as required. The main reason is that the relevant policy contents and performance targets are not reported in the budget, and the realization of relevant performance targets is not reported in the draft final accounts.

(2) Financial management audit. The audit focused on budget allocation and management, capital security and performance, fiscal policy implementation and fiscal and taxation reform. In 2015, the Ministry of Finance, the Development and Reform Commission and other departments seriously organized and implemented a proactive fiscal policy, increased the overall use of fiscal funds, innovated the investment and financing system, accelerated the progress of budget implementation, and further standardized budget and investment management. The main problems found in the audit:

1. The overall coordination of budget arrangement is not in place.

First, there is not enough convergence between budget allocation and project determination, and some projects are lagging behind. In recent years, the proportion of the general public budget has been increasing at the beginning of the year, but in 2015, the central level project expenditure and special transfer payment were 205.275 billion yuan (accounting for 13%) and 677.83 billion yuan (accounting for 38%), respectively, which have not been implemented by departments or regions at the beginning of the year; The proportion of investment in the central budget refined to regions at the beginning of the year also needs to be improved. During the budget implementation, there are 12.061 billion yuan of projects that have not been determined or have no implementation conditions when the budget is issued, which affects the timely use of funds, of which 1.02 billion yuan from three departments is added to the balance by the end of the year; 2.7 billion yuan to support the protection of 900 traditional villages was distributed to 30 provinces in April 2015, and only 491 villages (55%) were identified in that year.

Second, there is insufficient connection between budget allocation and special planning, and there is also a lack of overall coordination between some special planning. Spot check on the implementation of the Twelfth Five-Year Plan for water pollution prevention and control in key river basins in 18 provinces shows that 1,684 projects (accounting for 44%) included in the plan of 9 provinces were not subsidized by the central government, while 2,135 projects (equivalent to 63% of the planned projects) in 7 provinces were subsidized. Some budgets allocate funds according to multiple plans, and these planning objectives are not consistent, which is not conducive to the orderly progress of the project. For example, nine special arrangements of the central government have subsidies related to high-standard farmland construction, and there are only four national plans in the plans on which the budget is allocated.

Third, there is insufficient connection between budget allocation and system regulations, and some special projects have no management methods or relevant regulations are not clear enough. When the Development and Reform Commission allocated 85 special projects to subsidize local investment, 32 were based on management measures, 33 were based on special plans, 8 were based on implementation plans, and others were based on internal signing and notification. The three special management measures, such as the transformation of weak schools in rural compulsory education allocated by the Ministry of Finance, are only stipulated in principle, and the actual allocation is discussed one by one. Some systems are not strictly implemented. The Development and Reform Commission allocated 78.48 million yuan in subsidies for three special investment projects, including the construction of cultural facilities at the municipal level, which exceeded the scope, application and standards.

Fourth, the division of several budgets is not clear enough, and some projects are cross-arranged. Among them: for 53 projects in three departments, the government fund budget and the general public budget are 26.806 billion yuan and 2.946 billion yuan respectively; The government fund budget and the general public budget are 5.419 billion yuan and 380 million yuan respectively for the universal service of telecommunications and the renovation of venues for minors’ off-campus activities.

2. The transfer payment system needs to be improved.

First, some general transfer payments still have designated purposes. In 2015, general transfer payments accounted for 57% of local transfer payments, down 2 percentage points from the previous year, of which 1.35 trillion yuan was earmarked, and only 52% of local transfer payments could actually be coordinated, especially 25% of balanced transfer payments were also earmarked. The Ministry of Finance should accelerate the reform of transfer payment and prevent the general transfer payment from being "specialized".

Second, the multi-head management of special transfer payment needs to be improved. There are 52 special transfer payments actually broken down into 301 specific items, most of which are still allocated according to the original channels and original management methods. The spot check of the special agricultural comprehensive development was actually decomposed into 13 specific items, of which 3 were allocated by the Ministry of Finance and 10 were allocated by the Ministry of Finance in conjunction with other five departments; The special project to guide the development of local science and technology has integrated the two special projects allocated by the two departments of the Ministry of Finance, but they are still allocated by the two departments according to the original two management methods.

Third, the management of special transfer payment is weak. Mainly because there are many distribution links and long management chains, the situation of "small, scattered and chaotic" has not been changed for a long time. Among the special subsidies for the construction of revolving dormitories in 5,806 township health centers arranged by the Development and Reform Commission in 25 provinces, a single project is only 50,000 yuan; Of the 41 projects that were randomly selected for central investment subsidies, 13 received subsidies of 86.37 million yuan by using false information and illegal multi-head declarations; Among the subsidies for agriculture, forestry and water affairs in 69 counties, 1.383 billion yuan (accounting for 5%) was defrauded, occupied or wasted. For example, an insurance company in Lixian County, Hunan Province colluded with 29 township governments to defraud 40.6103 million yuan from 2013 to 2015 through false insurance, false reporting and false claims settlement, and the township government made a profit of 1677 through "return".

3. Financial management performance needs to be further improved.

First, some budget arrangements do not fully consider the carry-over balance. The Ministry of Finance continued to compile a budget of 1.006 billion yuan for three projects, including renewable energy development with an implementation rate of less than 60% for two consecutive years, and carried over 889 million yuan (accounting for 88%) at the end of the year; In the case that five projects, including the management of national tax system, carried over 142 million yuan last year, another 131 million yuan was budgeted, and the carry-over increased to 196 million yuan at the end of the year.

Second, the implementation progress of some budgets is slow. Among the transfer payments arranged in the general public budget, government fund budget and state-owned capital operation budget, 293.47 billion yuan (accounting for 6%), 95.901 billion yuan (accounting for 71%) and 12.43 billion yuan (accounting for 100%) were not issued within the prescribed time limit respectively. The slow progress of some projects has caused a large amount of funds to be carried forward, and the balance of 18 projects with special subsidies for the development of the central cultural industry was 199 million yuan at the end of the year (accounting for 83% of the total subsidies); Of the 42 central departments randomly selected, 6 departments and 3 subordinate units had a balance of 2.695 billion yuan carried forward by the project at the end of the year, and another 177 million yuan was transferred to the project unit through appropriation instead of expenditure.

Third, some tariffs and import and export link taxes are not collected in time. Because the customs, banks and treasury are not fully networked, paper tax bills are written off, and the scale of tax withholding is increasing year by year. In 2015, 19.468 billion yuan of tax was withheld for more than 15 days. Spot-check of 23 customs areas found that there were 281 enterprises whose deposits that should be converted into taxes were overdue for 709 million yuan, with an average overdue of 38 days, of which 10.7071 million yuan was overdue for 3 months.

Fourth, the scope of financial authorization payment is not detailed enough. Mainly, the Ministry of Finance classifies the goods and services expenditure in basic expenditure and the non-government procurement expenditure of goods and services in project expenditure as authorized payment, which not only increases the handling fee expenditure, but also is not conducive to ensuring the safety of funds. A spot check of 83.486 billion yuan of authorized payment found that the handling fee to the correspondent bank was equivalent to 22 times of the handling fee under the direct payment method; 6.845 billion yuan of financial funds were illegally transferred to the actual fund account by the budget unit, which was out of financial supervision.

(three) the audit of the budget implementation of the central department. Forty-two central departments and 241 subordinate units were audited, and the financial expenditure budget was 189.162 billion yuan, accounting for 36% of the total expenditure budget of these departments. Generally speaking, these departments can conscientiously implement the budget, strictly control and reduce the "three public" funds, strengthen the management of carry-over surplus funds, improve the financial and budget management system, and strive to improve the performance of the use of financial funds, and the budget implementation is good. The main problems found in the audit:

1. Illegal withdrawal and use of funds still occur from time to time. Mainly: the Ministry of Justice, the Environmental Monitoring Institute of the Ministry of Land and Resources, the Nuclear and Radiation Safety Center and other six affiliated units obtained financial funds of 66,945,900 yuan through repeated declaration of projects or overstatement of the number of people; Seven departments, including the Ministry of Education, the Development and Reform Commission and the People’s Bank of China, and 37 affiliated units, including China Academy of Water Resources and Hydropower Research and China International Electronic Business Center, have not included 924 million yuan in departmental budget management. For example, Kunming Customs has deposited 11,979,500 yuan from the disposal of smuggled goods outside the account for business expenses and welfare. In addition, we also found that the final accounts of completion were not handled in time and the government procurement was not standardized, involving an amount of 6.133 billion yuan.

2. The budget guarantee measures of public institutions are not clear enough. Mainly, it is common that basic expenditures crowd out project expenditures and personnel funds crowd out public funds. From 2014 to 2015, 19 institutions, such as Satellite Environment Application Center and Market Research Center of the State Administration for Industry and Commerce, crowded out 236 million yuan of supplementary personnel funds such as project expenditures and public funds, and some units’ personnel funds exceeded the financial allocation by nearly four times.

3. Some departments and subordinate units use departmental power or influence to obtain income. Mainly: the Ministry of Civil Affairs, the Chinese Society of Environmental Sciences, and the Information Center for Senior Talents illegally carried out activities such as reaching the standard of appraisal or qualification examination, from which they charged 13.5148 million yuan; Seventeen affiliated units, such as China Communications Information Center, China Construction Industry Association, and Central United (Beijing) Certification Center, received 578 million yuan in consulting services from participating units while being entrusted by departments to carry out activities such as evaluation, appraisal and reaching standards. Among them, the Scientific Research Institute of the Ministry of Transport received 16.309 million yuan in the name of technical services when it was entrusted with the evaluation, technical guidance and acceptance review of the title of "transit metropolis".

4. Some departments and units have not fully implemented the management systems of "three public funds" and conference fees. All departments attach importance to strengthening the management of "three public funds" and conference fees, and the number of violations has been significantly reduced. The main problems found in this audit:

First, going abroad on business. Mainly: 8 units, such as the Study Abroad Service Center of the Ministry of Education and the China Chamber of Commerce for Import and Export of Mechanical and Electrical Products, illegally organized 5 trans-regional and inter-departmental groups, and 8 groups with problems of changing routes or extending time; Four departments and 11 affiliated units charged or passed on expenses for going abroad (territory) of 3,844,200 yuan without budget or over budget, including 1,140,700 yuan from CBRC and 924,600 yuan from All-China Women’s Federation.

The second is the official car. Mainly: four subordinate units, such as the Service Bureau of the Ministry of Commerce, the China-Japan Friendship Environmental Protection Center and china population communication center, occupied 9 vehicles of other units for a long time without compensation, and three departments, such as the State-owned Assets Supervision and Administration Commission, failed to clear and hand over 10 official vehicles in time; There are problems in 20 affiliated units, such as the operating expenses of official vehicles exceeding the budget and the purchase of official vehicles exceeding the standard, involving an amount of 6,232,700 yuan, including 1,255,600 yuan for three affiliated units of the Ministry of Land and Resources and 598,000 yuan for two affiliated units of the Ministry of Civil Affairs.

The third is official reception. Mainly, 3 departments including the General Administration of Customs and 16 subordinate units such as China Youth Travel Group Corporation and National Culture Palace charged 2,409,800 yuan for exceeding the standard and passed on the reception fee. In addition, the disposal methods of consumer goods such as drinks purchased before the promulgation of the eight central regulations and other documents are not clear.

The fourth is the conference fee. Mainly: 3 departments and 21 affiliated units spent 16.511 million yuan on meeting expenses, including 10.8184 million yuan from China Nonferrous Metals Industry Association and 577,900 yuan from China Academy of Agricultural Sciences; Four departments and 20 affiliated units held 263 meetings in non-designated hotels outside Beijing, including 248 affiliated units of the Ministry of Transport. Three departments and three affiliated units were paid 924,700 yuan by other units, including 324,600 yuan by the National Library and 190,800 yuan by the Ministry of Housing and Urban-Rural Development.

The relevant departments are actively rectifying the above problems, and have turned over 84.9684 million yuan to the state treasury, recovered or refunded 89.1692 million yuan, and adjusted the accounts by 2.313 billion yuan.

Second, the key special audit situation

(a) the local government debt audit. The audit focused on 11 provinces, 10 cities and 21 counties. Judging from the audit, relevant departments and localities have established and improved debt financing and risk early warning mechanisms, improved relevant systems, and further strengthened government debt management. By the end of 2015, the government debt balance of 11 provinces at the same level was 820.2 billion yuan, or the contingent debt balance was 1,097 billion yuan. The main problems found in the audit:

1. Some local debt financing has not been effectively used. Spot checks found that by the end of 2015, among the replacement bonds issued by six provinces including Heilongjiang, Shandong, Hunan, Beijing, Inner Mongolia and Guangdong, 13.84 billion yuan (2%) was not used in time, mainly due to the failure to reach an early repayment agreement or the delay in repayment procedures; Among the replacement bond financing used in Hunan, Shandong, Henan and Guangdong provinces, 11.257 billion yuan (2%) failed to repay the debt according to the prescribed priority; Among the new bond financing in Inner Mongolia, Zhejiang and Hunan provinces, 2.423 billion yuan (4%) has not been used because the project has not been implemented.

2. Some areas still violate the rules or borrow in disguise. Spot checks show that by the end of 2015, four provinces, including Zhejiang, Sichuan, Shandong and Henan, had a debt balance of 15.35 billion yuan through illegal guarantees, fund-raising or promised repayment. In some places, there are some hidden debts. Four provinces, including Inner Mongolia, Shandong, Hunan and Henan, agreed to pay construction funds in the name of government purchasing services, involving financing of 17.565 billion yuan. Among the 23.594 billion yuan of funds raised by the four provinces of Zhejiang, Henan, Hunan and Heilongjiang in infrastructure construction, there are different degrees of government commitments to buy back social capital and solidify income.

In response to the above problems, relevant departments are studying to strengthen debt management, and relevant places are actively rectifying.

(2) Audit of poverty alleviation funds. The distribution, management and use of poverty alleviation funds were audited, and 40 counties in 17 provinces were selected. From 2013 to 2015, these 40 counties received 10.998 billion yuan of financial poverty alleviation funds and audited 5.013 billion yuan (accounting for 45%), involving 364 townships, 1,794 administrative villages and 3,046 projects. Judging from the audit, these places have conscientiously implemented the relevant requirements of poverty alleviation work, vigorously implemented precision poverty alleviation and precision poverty alleviation, continuously increased investment in poverty alleviation and development, strengthened the management of poverty alleviation funds, and promoted poverty alleviation projects in an orderly manner, achieving positive results. The main problems found in the audit:

1. Part of the allocation of funds did not fully consider the situation of poverty-stricken people who established the card. Some poverty alleviation funds allocation has not yet established an effective linkage mechanism with the data of poverty-stricken population with the establishment of the file card. In the implementation of specific poverty alleviation projects, some places have not strictly screened the poverty-stricken objects according to the prescribed conditions. Of the 1,339 poverty-stricken household discount loans of 65.6 million yuan issued by Xundian County in Yunnan Province in 2015, only 711 loans of 34.33 million yuan (accounting for 52%) were issued to poor households with the file card.

2. 151 million yuan of poverty alleviation funds were falsely reported or used illegally. Among them: 59 units and 28 individuals in 29 counties falsely claimed or defrauded 55.7313 million yuan of poverty alleviation funds by forging contracts, fabricating household subsidy payment forms, repeating declarations, and recording false invoices; The finance, poverty alleviation departments of 14 counties, township governments and village committees illegally used 60.9135 million yuan for non-poverty alleviation areas such as balanced budget, municipal construction and hotel renovation; 25 units in 17 counties used 21.9478 million yuan to make up for business expenses and distribute benefits; Seven units illegally collected 12,493,600 yuan of project promotion fees in poverty alleviation work, which was mainly used to make up for the funds.

3. 870 million yuan of poverty alleviation funds are idle or wasted. Because the overall integration is not in place, the poverty-stricken counties that have been spot-checked receive more than 200 special subsidies from their superiors every year, and the least single project is only 4,800 yuan; Of the 5.013 billion yuan poverty alleviation funds randomly selected, 843 million yuan (accounting for 17%) had been idle for more than one year by the end of March 2016, of which 260 million yuan had been idle for more than two years, the longest being more than 15 years; After the completion of 29 poverty alleviation projects in 17 counties, they were abandoned, idle or failed to achieve the expected results, resulting in a loss of 27.0611 million yuan.

After the audit pointed out the problems, the relevant localities have recovered 14.226 million yuan of funds and recovered 69.8159 million yuan of idle funds.

(3) Follow-up audit of affordable housing projects. Judging from the national audit, in 2015, the financial investment at all levels in urban affordable housing projects and rural dilapidated housing renovation increased by 17% and 40.6% respectively over the previous year; The number of families enjoying housing security benefits and the number of rural dilapidated houses that have been renovated increased by 17% and 62% respectively, effectively improving the living conditions of urban and rural residents. The main problems found in the audit:

1. The implementation of relevant policies is not in place. In terms of subsidies and treatment distribution, 48,500 non-poor or subsidized families received subsidies of 424 million yuan for the renovation of dilapidated houses in rural areas; There are 58,900 unqualified urban families who enjoy 60,462,500 yuan of affordable housing subsidies and 37,700 sets of housing. In terms of fiscal and taxation financial support policies, 891 projects failed to enjoy tax relief of 2.249 billion yuan as required; There are 25.8 billion yuan of financing, such as shed reform loans, which are charged intermediate fees or do not enjoy preferential interest rates. In addition, the implementation of the green channel policy is not in place, and the supervision is not strict. There are 4,287 projects in 1,339 cities and counties (accounting for 29% of the spot check projects) with problems such as unapproved construction, illegal land occupation, and failure to bid according to law.

2. There are more than 140 units and more than 180 compensation objects to defraud financial funds. Among them, 41 grass-roots agencies and some village and town cadres defrauded and occupied 14,483,800 yuan of subsidies for the renovation of dilapidated houses in rural areas by falsely claiming, withholding or collecting "deposits"; 184 families and 3 units defrauded the compensation for land acquisition and demolition of 96.1788 million yuan by fabricating property rights information; 102 units took financial funds of 455 million yuan by overstating the number of households, repeating declarations and fabricating the roster of farmers.

3. There are 866 cities and counties with problems such as idle funds or insufficient housing utilization. The audit found that by the end of 2015, 748 cities and counties had carried over a total of 60.355 billion yuan of special funds (equivalent to 3% of their investment in that year), of which 47.86 billion yuan had been idle for more than one year; There are 190,000 sets of affordable housing that cannot be delivered in time due to the lag in supporting infrastructure construction, and 6,544 sets of housing are illegally sold or leased.

After the audit pointed out the problems, the relevant localities have used 933 million yuan of funds as a whole, recovered 118 million yuan, refunded 106 million yuan of overcharged taxes and fees, cancelled or adjusted 15,000 households, cleared, recovered and allocated 7,231 sets of housing, and handled 352 people.

(four) the audit of industrial injury insurance fund. The 17 provinces audited were able to implement the relevant national requirements, continuously expand the coverage of insurance coverage, and strive to safeguard the rights and interests of employees. However, in some places, the implementation of policies is still not in place, and there are still weak links in fund distribution and management. The spot check found that 170,000 units failed to apply for work-related injury insurance for 1,149,500 employees, and 103,600 "old work-related injuries" in six provinces have not been included in work-related injury insurance; 141 million yuan of funds were fraudulently obtained, illegally distributed and used, among which 17 medical rehabilitation institutions and 441 people fabricated information to defraud or impersonate 68.4776 million yuan of funds, 63 agencies and relevant units illegally distributed insurance benefits of 16.6208 million yuan to 809 people, and also used 55.9671 million yuan for personnel and office expenses. In addition, problems such as irregular financial management were found to be 245 million yuan. After the audit pointed out the problems, the relevant localities recovered 60.306 million yuan of funds, and corrected the irregular financial management problems involving 11.07 million yuan.

(five) the prevention and control of water pollution and the audit of related funds. The 18 provinces audited have continuously increased investment and actively promoted the construction of water pollution prevention and control projects. In the past five years, the water quality of key state-controlled and provincial-controlled sections in the region has increased by 33 percentage points and decreased by 32 percentage points. The main problems found in the audit:

1. Regional water environmental protection pressure is greater. Sampling 23 cities and counties along the Yangtze River Economic Belt, 12% (400 million tons per year) of urban domestic sewage is discharged directly into the Yangtze River without treatment; Among the 373 ports along the Yangtze River, 359 (96%) are not equipped with ship garbage receiving points, and 260 (70%) are not equipped with pollution emergency treatment facilities. Among 231 urban and rural centralized drinking water sources sampled from 89 cities and counties, 124 (53%) water quality monitoring indicators were not up to standard; Of the 72 groundwater sources, 27 (37%) are over-exploited.

2. 397 projects failed to achieve the expected results. By the end of 2015, of the 883 water pollution prevention and control projects sampled, 276 (31%) failed to start (finish) work on schedule due to insufficient preliminary preparation and imperfect supporting facilities; There are 121 completed projects (accounting for 13%) that failed to bring benefits into play in time.

3. 17.621 billion yuan of financial funds have not been effectively used. By the end of 2015, 14.359 billion yuan of central special subsidies had been deposited in local financial departments, of which 422 million yuan had been stranded for more than two years; Of the project funds, 2.928 billion yuan is idle in local authorities and project units, of which 940 million yuan has been idle for more than 3 years; Another 334 million yuan was illegally taken or lost.

In response to the above problems, the relevant localities accelerated the implementation of 77 projects, allocated 2.345 billion yuan, revitalized and used 802 million yuan as a whole, and returned 260 million yuan.

(six) the development, utilization and protection of mineral resources and the audit of related funds. From the audit of 1724 mining rights and related funds in six provinces, the relevant departments and localities have continuously strengthened the management of mineral resources, standardized the collection and management of related funds, and improved the level of resource protection and resource development and utilization. The audit found that the supervision and law enforcement in some places were lax, and there were 391 cases of illegal mining rights in the examination and approval, transfer or development management, among which: the land and resources department approved 88 cases of illegal mining rights; State-owned mining enterprises illegally transferred or acquired 92 mining rights and related shares; State-owned geological prospecting units or individuals involved in 104 mining rights declarations or transactions by using internal information such as geological prospecting data, and sought personal gain from them; The relevant local authorities approved the establishment of 63 mining rights in the forbidden mining area in violation of regulations, and did not make exit arrangements for 44 mining rights that existed before the establishment of the nature reserve. In addition, it was found that illegal collection and use of mining rights related funds was 3.581 billion yuan, of which 628 million yuan was used for foreign investment, lending or personnel funds. After the audit pointed out the problem, the relevant localities rectified the problem by recovering and confiscating illegal income, amounting to 990 million yuan.

Iii. Follow-up audit on the implementation of policies and measures

Organize audit institutions at all levels to continuously carry out follow-up audits, focusing on the implementation of policies and measures to stabilize growth, promote reform, adjust structure, benefit people and prevent risks in various departments and regions. The National Audit Office directly tracked and audited 29 provincial-level and 36 central departments, and through auditing more than 5,200 units involved in more than 80 policies in 23 aspects, it promoted 9,408 newly started and completed projects, and accelerated the approval or implementation of 9,454 projects; Accelerate the release of financial funds of 528.822 billion yuan, recover the balance of funds carried forward of 114.425 billion yuan, and integrate and coordinate the use of funds of 73.21 billion yuan; Promote the cancellation, merger and decentralization of 134 administrative examination and approval items, cancel 241 professional qualifications and enterprise qualification identification, and stop or cancel 111 fees; Promote the improvement of more than 50 systems and introduce more than 20 risk prevention measures; 2,138 people were dismissed and suspended for inspection, and more than 90 people were transferred to discipline inspection and supervision and judicial organs for investigation. The audit found that there are some problems worthy of attention in the implementation of policies and measures:

(1) The establishment and improvement of institutional rules in some areas need to be accelerated. In terms of system, laws and regulations that affect the standardization of special funds clearing and integration, and require the arrangement of linking expenditures for key issues have not been adjusted in time, and the inter-domain and structural imbalance of expenditures is more prominent. The contradiction between the large funding gap in budget implementation and the coexistence of some funds lying on the account "sleeping" still exists. In terms of standards, the investment standards of agriculture-related projects are low, especially in compensation for land acquisition, demolition and resettlement. The compensation standards of some agriculture-related projects are less than half of those of railway and highway projects, which leads to difficulties in land acquisition, demolition and resettlement. In terms of assessment, the relevant incentive assessment mechanism has not yet adapted to the development requirements, and the objectives and tasks of rural drinking water safety, rural land consolidation, energy conservation and emission reduction are not completely consistent with the local actual situation.

(2) The reform of examination and approval management of major projects needs to be accelerated. Spot check of 172 expressway construction projects in 11 provinces requires an average of 26 examination and approval procedures involving 9 departments, and an average of 22 pre-service services such as feasibility study report and industry consultation, and some items are repeatedly examined and approved by multiple departments or the same department for many times, with an average examination and approval period of 3.5 years. Regarding the problems reflected in the audit, the relevant departments conducted a special study, and 81 items of intermediary services for standardized examination and approval have been cleared up, but some factors restricting the progress of the project have not been eradicated, and some of them have been repeatedly examined and approved before and after construction; Some approvals and reviews are in a cyclical dilemma; Some have not made clear the time limit for handling after the approval and filing, which has affected the progress.

(3) Policies and measures related to the overall integration of financial funds need to be implemented urgently. The State Council has repeatedly requested to increase the overall integration of financial funds, and relevant departments and localities have actively taken measures. The audit has continued to promote the revitalization of stocks and overall integration, and has repeatedly proposed amendments or abolishment of specific system provisions that are not suitable. The audit found that, because the management authority of special funds is scattered in different departments, the competent authorities are unwilling to integrate as a whole, for fear of losing the administrative power, for fear that the functions will be adjusted, for fear that the staffing of institutions will be reduced, and for grass-roots governments, for fear of losing special support, for fear of offending the competent authorities and for fear that the performance will be affected, it is difficult to fully implement the requirements for the overall integration of financial funds.

(D) The role of government investment funds in supporting innovation and entrepreneurship has not been effectively brought into play. By the end of 2015, of the 13 government investment funds funded by the central government, 108.251 billion yuan (30%) remained unused. A spot check of the venture capital guidance fund found that among the 206 sub-funds approved, 39 could not be established on schedule because they did not attract social capital, and the financial funds of 1.367 billion yuan were stranded in the custody account; Of the 167 established sub-funds, 14.888 billion yuan (41%) was unused, and 14 of them had never been invested. A similar phenomenon exists in local government investment funds. A random inspection of six local funds shows that 12.4 billion yuan (66%) of the financial investment of 18.75 billion yuan has been converted into time deposits of commercial banks.

(E) scientific research investment management mechanism does not meet the requirements of scientific and technological innovation. Tracking the implementation of policies such as auditing the construction of an innovative country, mass entrepreneurship and innovation, it is found that the management system of scientific research projects and funds is still not perfect, the scientific research funds are over-managed, the tangible cost accounts for a large proportion, the intellectual cost compensation is not enough, and the conversion rate of scientific research results is low. Judging from the spot check of the use of scientific and technological funds in 11 central departments and units, the amount of problems such as expanding the scope of expenditure and using fake invoices for reimbursement reached 317 million yuan, including the situation that invoices had to be collected everywhere to ensure necessary expenditures, and some individuals took the opportunity to defraud and obtain scientific research funds. In this regard, in recent years, the audit has continued to pay attention to it and made efforts to promote the establishment of relevant systems that conform to the laws of scientific research, are conducive to mobilizing and protecting the enthusiasm of scientific researchers, encouraging innovation and producing more results. The audit also found that there were many inspections of scientific research institutions and scientific research projects, which increased the burden on scientific research institutions. For example, from 2013 to 2015, 85 institutes affiliated to the Chinese Academy of Sciences received more than 3,500 inspections and evaluations, of which 760 were conducted in the name of "audit". During this period, the Audit Office only extended the audit of 15 institutes in the audit of departmental budget implementation of the Chinese Academy of Sciences.

To these problems, we need to further improve the system and mechanism, and gradually solve them.

IV. Audit of financial institutions

Five financial institutions, including the Agricultural Bank of China, were audited, and loans from eight key commercial banks were continuously tracked. These financial institutions can implement the national macro-control policies, strengthen management and risk control, maintain steady operation, and improve their financial innovation and service capabilities. The main problems found in the audit:

(1) The problems of difficult, expensive and slow financing in the real economy have not been effectively solved. In 2015, the financing difficulties of the real economy generally eased, but the growth rates of corporate loans, agriculture-related loans and small and micro enterprise loans were 3.64%, 6.23% and 8% respectively when the growth rate of all loans of the eight key commercial banks sampled was 9.48%. According to the survey, in order to obtain credit support, small and micro enterprises not only need to bear other expenses besides interest, but also often need to increase the guarantee and evaluation links, which prolongs the audit time and is not conducive to ensuring the capital needs of production and operation.

(2) The risk prevention and control mechanism related to the disposal of non-performing loans and financial innovation of commercial banks is still not perfect. In 2015, the balance and NPL ratio of eight banks showed a Shuang Sheng trend. Due to the convergence of risk preference and credit investment of these commercial banks, the areas where NPL occurred tended to be concentrated; The disposal of non-performing loans needs to be strengthened. Only 33% of new non-performing loans are transferred to asset management companies in batches, and the provision coverage ratio of eight banks has declined, increasing the pressure on their own write-offs. The prevention and control of risks related to financial innovation is insufficient, and financial supervision needs to be strengthened.

(3) The problem of illegal operation is still outstanding. The audit found that some staff of financial institutions had problems such as illegal lending, illegal insurance or bond and stock business, and 18 cases were suspected of major violations of the law; The risk prevention and control of some credit businesses needs to be further strengthened, and it is found that more than 12 billion yuan of new financing has been added to some enterprises that have been included in the national list of eliminating backward and excess capacity; After the promulgation of the eight central regulations, five financial institutions, namely Everbright Group, Agricultural Bank of China, People’s Insurance Group, China Life Insurance Group and Taiping Insurance, had 72.623 million yuan of problems such as over-standard car purchases and meetings in scenic spots.

In response to the above problems, relevant financial institutions have rectified 20.753 billion yuan, revised and improved 103 systems, and pursued accountability for 219 times.

V. Audit of central enterprises

It mainly audited 10 central enterprises such as China Petrochemical, China Southern Airlines Group and Chinalco, and made spot checks on the management of some overseas businesses of central enterprises. These enterprises continue to improve the system, strengthen management, open up markets, and the scale of assets and income continues to grow. The main problems found in the audit:

(a) the business results of enterprises are not true, and some of them violate the provisions on honest employment. The audit found that the assets, income and profits of 10 enterprises were 6.406 billion yuan, 58.582 billion yuan and 7.196 billion yuan respectively. Irregular problems in engineering construction, material procurement and investment involved 80.876 billion yuan, resulting in losses and waste of 2.084 billion yuan. After the promulgation of the eight central regulations, eight units belonging to seven enterprises, including China Electronics, China CNOOC and Hong Kong China Travel Service Group, illegally distributed subsidies of 5,912,300 yuan, involving 64 members of the unit leadership team; 70 units belonging to 10 enterprises have problems involving 1.116 billion yuan, such as illegal purchase and construction of buildings, over-standard meetings, car purchases, public travel and golf.

(2) The accountability system and mechanism for enterprises are not perfect, and problems such as illegal decision-making are more prominent. In recent years, the audit found that enterprises were dereliction of duty, violating relevant policies and regulations, and the "three majors and one big" decision-making system caused losses. The regulatory authorities did not perform their duties of urging rectification, accountability and reporting announcements, and did not specify the standards for confirming and accountability for major losses of enterprises. They mainly relied on enterprises to pursue their own responsibilities and accountability, resulting in weak constraints, which led to repeated trials and even accumulation of some problems. Of the 284 major economic decisions made by 10 enterprises in this audit, 51 have problems such as illegal decision-making, procedural decision-making and improper decision-making, resulting in losses and waste of 12.682 billion yuan; It was found that 47 clues about major violations of discipline and law involved 29.502 billion yuan, of which 16 involved more than 100 million yuan, and 26 of the 94 responsible personnel were business leaders.

(3) The overseas business management of the enterprise is weak. Of the 93 overseas businesses randomly selected, 62 (67%) have problems of insufficient argumentation, failure to submit for approval according to procedures, and weak control over key business links such as personnel supervision and commission payment in key positions, among which 10 clues about major violations of discipline and law have caused the risk of loss of state-owned rights and interests of 14.27 billion yuan.

In response to the above problems, 10 enterprises have recovered 2.743 billion yuan of funds, established and improved 609 rules and regulations, and handled 453 person-times.

VI. Clues of major violations of discipline and law transferred by the audit

The main features of the clues of major violations of discipline and law found and transferred by the above audit are:

(a) the abuse of public power such as administrative examination and approval and the management of state-owned assets and resources for personal gain is still outstanding. There are 287 clues of such problems, mainly related to direct or disguised intervention, illegal examination and approval, and black-box operation by leading cadres, conveying benefits to relatives and friends or other specific objects, and accepting money, real estate, equity, etc. After the above clues were transferred to the discipline inspection, supervision and judicial organs, more than 270 people have been dealt with.

(2) Grass-roots managers collude inside and outside, and "through-train" fraud is used to defraud and obtain special financial funds. There are 55 clues of such problems, mainly because the managers of the relevant departments at the county and township level actively participate in or assist enterprises and individuals to forge, and defraud financial subsidies such as comprehensive agricultural development, demolition and resettlement, and poverty alleviation by forging official documents and seals, forging bank credit certificates, forging contracts or business information, and stealing farmers’ identity information. For example, Ganyu Rural Commercial Bank in Jiangsu Province inflated the scale of poverty alleviation loans by fabricating loan ledgers and repayment documents, and defrauded financial discount subsidies and loan incentives for poverty alleviation loans totaling more than 20 million yuan, from which local poverty alleviation and finance departments obtained more than 4 million yuan. Some also set up special "funds" to "manage" the staff in the project application, review, acceptance and settlement.

(3) The staff of financial institutions and relevant enterprises illegally use inside information for profit. There are 59 clues of such problems, mainly using the inside information such as bond issuance, stock trading, suspension and resumption of trading, corporate mergers and acquisitions, directly or borrowing the name of others, or organizing related accounts to implement convergent transactions, and even promoting specific stock price fluctuations to profit from them.

(four) with the help of network technology, organized, large-scale, cross-regional implementation of illegal fund-raising, money laundering and other activities. There are 32 clues of such problems, 10 of which are illegal fund-raising in the name of member mutual assistance and public welfare investment by registering a series of shell companies, establishing a special network platform and promising high returns; In the other 22 cases, fictitious transactions were used to transfer funds from many places through the bank account chain of rotation operation, and high-frequency rapid transfer between accounts was carried out, and finally transferred to designated domestic and foreign accounts, which was suspected of illegal money laundering.

The problems found in the above audit, in violation of financial revenue and expenditure laws and regulations, have been issued an audit decision in accordance with the law, requiring the relevant units to correct them; Clues about major violations of discipline and law and those who should be held accountable have been transferred to relevant departments for investigation according to law; If the management is not standardized, it has been suggested that the relevant departments establish rules and regulations to effectively strengthen internal management; Important issues involving policies, systems and regulations have been proposed to be studied and solved in a comprehensive way in combination with relevant reforms. This report reflects the main problems found in the audit, and the specific situation is announced to the public through the announcement of individual audit results. In the next step, we will continue to urge relevant departments, units and localities to seriously rectify, and the comprehensive situation of rectification will be reported before the end of this year.

VII. Audit recommendations

(1) Strengthen accountability and openness, and improve the long-term mechanism for rectification of problems identified by audits. Suggestions: First, relevant departments and regions should incorporate rectification into the supervision and supervision, especially the competent authorities should strengthen supervision and take the audit results and rectification as an important basis for assessment, reward and punishment. For those who fail to make rectification on schedule and rectification is not in place, accountability shall be implemented. Second, the main person in charge of the audited entity should earnestly fulfill the first responsibility of rectification, promptly correct violations of discipline and discipline, improve relevant systems, and prevent similar problems from happening again; We should promptly organize research on the institutional problems reflected by the audit and the audit suggestions put forward, and actively promote the clean-up of unsuitable institutional provisions. Third, the audited entity should report the rectification results to the government at the same level or the competent department and announce them to the public in a timely manner.

(2) Accelerate reform and ensure the implementation of major policies and measures. Suggestions: First, speed up the clean-up and revision of relevant systems, not only revise and abolish policies and regulations that are not in line with the current reality, but also establish and improve institutional mechanisms that meet the requirements of reform and development as soon as possible, and improve relevant supporting policies and regulations. The second is to speed up the formulation and revision of relevant industry, industry, product, network and service standards, establish and improve a reasonable enterprise standard, industry standard and national standard system, and create a good environment for innovation, development, transformation and upgrading. The third is to speed up the improvement of relevant assessment and incentive mechanisms, ensure the coordinated convergence of assessment objectives and major development plans, and coordinate the convergence of assessment indicators at all levels at the central and local levels. The fourth is to strengthen the standardization, promotion, summary and promotion of exploratory practices, and establish and improve positive incentives and fault-tolerant exemption mechanisms.

(3) Further optimize the allocation of financial resources, effectively revitalize the stock and make good use of the increment. Suggestions: First, combined with the transformation of government functions, further clarify the powers and responsibilities of the central and local governments, rationalize the powers and responsibilities of departments in budget management, and improve the financial management system with reasonable allocation, clear responsibilities and efficient operation. The second is to optimize the expenditure structure, focus on supporting de-capacity, de-inventory, de-leverage, cost reduction and short-boarding, strictly control general expenditures, and do not arrange budgets for projects that are not ready. The third is to change the way of financial management, break down the institutional barriers that affect the overall planning of funds, enhance the coordination and effectiveness of relevant support measures to attract social investment, and make more use of discount loans and government procurement to support the real economy.

(four) actively take measures to alleviate the contradiction between revenue and expenditure, to prevent and resolve various risks. Suggestions: First, strengthen the overall coordination of fiscal revenue and expenditure and play the role of active fiscal policy more effectively. While continuing to reduce taxes and fees, we will strengthen tax collection and management in accordance with the law, ensure that all accounts receivable are collected, provide financial support for key expenditures, and resolutely curb the problem of defrauding and falsely claiming financial funds. Second, continue to strengthen the management of local government debt, promote the digestion of debt stock through strict accountability, strictly control the increment, and pay close attention to the potential risk points that may increase government debt, such as "open stocks and dark debts", buybacks at the bottom, and solidified income. Third, closely follow the innovation of financial business, strengthen financial supervision and cooperation, and severely crack down on illegal fund-raising, online fraud, underground money houses, insider trading and other criminal activities to prevent financial risks.

Chairman, vice-chairmen, Secretary-General and members, we will unite more closely around the CPC Central Committee with the Supreme Leader as the general secretary, fully implement the spirit of the 18th CPC National Congress and the Third, Fourth and Fifth Plenary Sessions of the 18th CPC Central Committee, sincerely accept the guidance and supervision of the National People’s Congress Standing Committee (NPCSC), perform the duties of auditing and supervision according to the decision-making arrangements of the CPC Central Committee and the State Council, and make due contributions to promoting sustained and healthy economic and social development!