ZhongHongWang stock December 26th. As a national strategic emerging industry, new energy vehicles are of great significance for promoting green development and achieving the goal of "double carbon". However, cruising range anxiety has always been an important factor restricting the development of new energy vehicles. The traditional charging mode not only takes a long time to charge, but also has many limitations in the construction of charging stations. At this time, the power exchange mode of "separation of vehicle and electricity" came into being, which has the characteristics of energy storage, energy supplement and sharing economy, and provides a new idea for solving this problem.

Industry research shows that the power exchange mode has many advantages. Specifically, it can not only complete the battery replacement more quickly, greatly shorten the charging time, improve the use efficiency, but also help to realize the recycling of batteries and reduce the use cost of users.

More importantly, the power exchange mode has the characteristics of energy storage, energy replenishment and sharing economy, so it is of great significance to promote the power exchange mode for the development of new energy automobile industry.

The policy leads the industry to develop logically and steadily, and the changing track welcomes new growth opportunities.

On December 21st, the National Conference on Industry and Informatization was held in Beijing. The meeting summarized the work in 2023 and deployed the tasks in 2024. The meeting stressed that in 2024, we should focus on high-quality development, highlight key points, grasp the key points, and do a good job in 12 key tasks. Boost large-scale consumption of new energy vehicles and electronic products. Key tasks include consolidating and upgrading the leading position of advantageous industries. That is, to speed up the chain extension of strong chains and enhance the competitiveness of the whole industry.

It is worth noting that, in the field of new energy vehicles, the Ministry of Industry and Information Technology emphasized that in 2024, it is necessary to support the development of new energy vehicles’ power exchange mode and do a good job in piloting the comprehensive electrification of vehicles in the public sector.

This time, the Ministry of Industry and Information Technology focused on clearly supporting the power exchange mode. In fact, there is no trace to be found. Since 2020, the National Development and Reform Commission, the Ministry of Industry and Information Technology and other departments have successively issued policies to clearly support the development of the power exchange industry.

In May, 2020, power exchange was written into the government work report for the first time. In October of the same year, China issued the "New Energy Automobile Industry Development Plan (2021-2035)", which proposed to encourage the application of power exchange mode. In October, 2021, the Ministry of Industry and Information Technology started the pilot application of new energy vehicles in 11 cities across the country. In November of the same year, "Safety Requirements for Electric Vehicle Switching" was officially implemented, which became the first basic universal national industry standard for China’s switching industry.

At the beginning of this year, eight departments, including the Ministry of Industry and Information Technology, jointly issued the Notice on Organizing the Pilot Work of Fully Electrified Vehicles in the Public Sector, demanding to improve the charging and replacing infrastructure construction and "build a moderately advanced, balanced, intelligent and efficient charging and replacing infrastructure system". This adjustment announcement further clarifies the technical standards and other relevant regulations that need to be met by the battery-changing models that enjoy the exemption of power batteries.

On December 21st, the Japanese Ministry of Industry and Information Technology made it clear that it would support the new energy vehicle power exchange mode in 2024, which undoubtedly further stabilized the development logic of the whole power exchange industry.

Under the background of frequent favorable policies, the changing track presents a clear policy leading line. In this regard, many institutions look at the power exchange industry strategically, and generally believe that the power exchange industry has a broad development space. According to orient securities’s forecast, by 2025, the proportion of domestic electric vehicles is expected to reach 30%. According to the research report of CITIC Securities, thanks to the active promotion of enterprises in all links of the industrial chain and the future prospect of replacing electric taxis and heavy trucks, it is expected that the power replacement industry will usher in a blowout development in the future. According to open source securities, the market size of China’s power exchange industry chain is expected to reach 133.4 billion yuan in 2025. Obviously, the blueprint of the 100 billion-level track in the power exchange industry is slowly unfolding, and the future market space is quite imaginative!

Car companies have accelerated the layout of the power exchange field, driving the market space expansion of the power exchange industry.

Driven by the policy and the market demand, the electric circuit has increasingly become a hot field of industrial investment, attracting many car companies to invest in the electric circuit business. According to the statistics of relevant media, in the past two years, car companies have become one of the main forces in the power exchange market, and many car companies including SAIC, GAC, Geely, Weilai and Chang ‘an have entered the market, injecting more vitality and competitiveness into the power exchange market.

It is worth noting that Weilai is an enterprise that takes the mode of power exchange as its main direction among vehicle brands, and it is also the main vehicle enterprise that promotes the mode of power exchange in China at present. From the landing of the first Weilai Power Station in 2018 to the appearance of the Weilai Third Generation Station in 2023, Weilai has iterated three generations of power stations in five years. In such rapid technological upgrading, the construction cost of Weilai Power Station continues to decline and the service efficiency continues to rise.

In November this year, Weilai Automobile officially announced the opening of power exchange business, and successively signed cooperation agreements with Chang ‘an and Geely for power exchange business. At the same time, it continued to discuss the cooperation of power exchange network with many enterprises, and the "Power Exchange Alliance" built by Weilai will also usher in a period of rapid expansion.

Haobo, a high-end electric vehicle brand owned by GAC Ai ‘an, launched the first model Haobo GT supporting power exchange in July this year. In order to meet users’ demand for power exchange, Haobo is also working hard to build a power exchange network. It plans to build 60 power exchange stations in Greater Bay Area in 2023, and it is expected to achieve the goal of 500 power exchange stations nationwide in 2025.

At the same time, giants such as Contemporary Amperex Technology Co., Limited, China Southern Power Grid, State Grid, Sinopec and PetroChina have also laid out the power exchange market and invested in a large number of power exchange stations and battery banks. These energy and power giants not only provide a solid guarantee for the sustainable development of the power exchange market, but also promote the prosperity and development of the new energy automobile industry through win-win cooperation.

With many industrial car companies actively participating in the power exchange track, it will undoubtedly further broaden the development space of the power exchange industry, and then drive the power exchange industry generate to develop more vitality!

The development prospect of the track is clear, and the power exchange equipment manufacturers are expected to show new growth vitality.

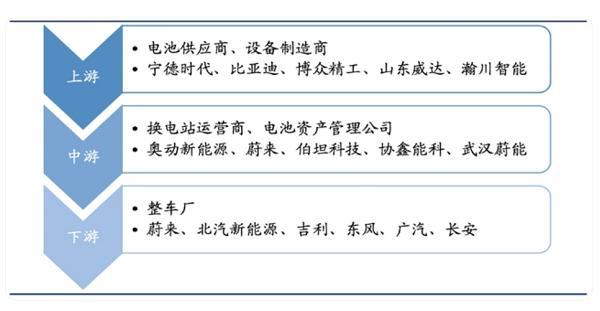

From the point of view of the industrial chain of power exchange track, it can be divided into battery suppliers and equipment manufacturers in the upstream power exchange station, power exchange station construction operators and power grid enterprises in the middle reaches, and new energy vehicle users and power battery recycling enterprises in the downstream.

Specifically, there are three main types of enterprises that currently deploy power exchange modes. The first type is power battery manufacturers and power exchange equipment manufacturers, such as Contemporary Amperex Technology Co., Limited, BYD and Hanchuan Intelligent. The second category is the third-party power exchange operators such as China Petrochemical, GCL-ENCO, and Aodong New Energy. The third category is automobile companies such as BAIC, Weilai, Geely and Guangzhou Automobile.

Source: Guotai Junan Institute

It is worth noting that as an independent equipment manufacturer in the upstream of the power exchange industry chain, it occupies a very critical position in the whole value chain. According to the industry research, according to the order of the use process of the power exchange station, independent power exchange equipment manufacturers can be divided into quick exchange system and charging system: the main players of the charging system include Titan Power, Tonghe Technology, etc., which mainly provide charging services for the replaced batteries in the power exchange station; The main players of the quick change system include Hanchuan Intelligent, Bozhong Seiko, Shandong Weida, HKUST Intelligent, etc., and mainly provide equipment products including power change stations and core components.

According to the relevant calculation of CITIC Securities, based on the number of new energy vehicles, thanks to the active promotion of enterprises in all links of the industrial chain and the future prospect of replacing electric taxis and heavy trucks, the penetration rate of changing electric vehicles will increase year by year from 2023 to 2026, among which the penetration rate of passenger cars in 2023/24/25/26 is 4%/6%/8%/10%, and that of commercial vehicles is 15%/26.

Based on the above calculations, CITIC Securities believes that the power exchange industry will usher in a blowout development in the future. It is estimated that the number of power exchange stations will reach 27,489 in 2026, corresponding to a CAGR of 93% from 2022 to 2026; In 2026, the market size of power exchange equipment is expected to reach 30.5 billion yuan.

It is not difficult to see that at the moment when the prospect of the whole power exchange track is clear and the development logic is stable, as an important pole of the power exchange industry chain, the power exchange equipment manufacturers, as the priority beneficiary end of the industry, are expected to show new growth vitality first, and the future development is worth looking forward to!