Author | Liu Ran

Title map | IC photo

# This article belongs to Tiger Sniff’s newly launched column "Shiny IPO". This column aims to pay attention to the newly listed companies this season, dismantle their industrial and investment values, and provide the public with a more comprehensive and accurate commercial interpretation, including articles, long pictures, short videos, live broadcasts and other forms.

The perfect diary, which is only three years old, has been on the stage of the New York Stock Exchange with the title of "the first domestic beauty".

On the evening of November 19th, Perfect Diary’s parent company, Yixian E-commerce, successfully went public with the stock code "YSG" and the issue price was US$ 10.5. Then it opened up nearly 70% and its share price closed at US$ 18.4 on the first day. As of press time, the market value of Yixian e-commerce exceeds 13 billion US dollars.

From the establishment of the brand to the first place in Tmall makeup, and then to the listing, the perfect diary has a smooth journey. Of course, there is the help of capital behind this. Since 2018, Yixian e-commerce has maintained the rhythm of financing at least once a year. This year, it won two financing in the unit of 100 million US dollars in April and September respectively. On the list of investors, there are many head institutions such as Zhenge Fund, Gaochun Capital, Gaorong Capital and Houpu Investment.

Why can Perfect Diary, together with other "online celebrity" cosmetics, stand out from the encirclement and become a phenomenal brand in the domestic beauty market, which has been shifted by the brand will of Europe, America, Japan and South Korea? This not only depends on the label of "domestic products" and capital, but also is considered as the victory of the new marketing era. In the media group interview on the evening of listing, Huang Jinfeng, founder and CEO of Yixian E-commerce, did not deny this initial impression, but he also said that according to the model of Yixian E-commerce, after the initial investment, there will definitely be a return period in a certain period of time in the future.

Therefore, how should we define the perfect diary? What kind of challenges does Yixian e-commerce face after listing? How far can the dividend in the new traffic era help it go? These problems are still worthy of further study.

Yixian e-commerce has come to this day, and this "diary" has actually been written to the first few pages.

First, do you make money with cost-effective beauty?

Within two years, the valuation of Perfect Diary once rose from $1 billion to $4 billion, and its value soared four times. It was not until the prospectus was published that the results of this dark horse in the beauty industry finally revealed the mystery: the revenue increased significantly from 640 million yuan in 2018 to 3.03 billion yuan in 2019, an increase of 377.1% year-on-year; The net income in the first three quarters of 2020 was 3.27 billion yuan, a year-on-year increase of 73.2%.

There is no need to repeat the story of the rise of the perfect diary. With the mature Internet infrastructure, social and short video platforms have brought new traffic dividends, and platforms such as Xiaohongshu, Tik Tok, bilibili and Tmall have become the promised land of the perfect diary.

According to the prospectus, Yixian e-commerce is the first beauty brand to use online KOL on a large scale. As of September 30, 2020, there were nearly 15,000 KOLs cooperating with Yixian e-commerce, including more than 800 KOLs with more than 1 million fans.

Up to now, Yixian E-commerce’s products often appear in various KOL video and live broadcast rooms. Even if you have never used its products, under the education of various forms of advertisements on these platforms, you may also call out the names of explosive products, such as animal eye shadow disks, feather satin powder cakes, Odin eyeliner, cat and mouse blush.

The perfect diary has really gone out of a different way from the so-called big-name beauty cosmetics. With the characteristic labels of "cheap", "good-looking" and "fast on the new", it quickly seized the cognition of the post-95 users who were active in Xiaohongshu, Tik Tok and bilibili.

The renovation of the Perfect Diary is very fast. When Li Jiaqi pushed the new feather satin powder in the live broadcast room, the popularity of the geographical eye shadow tray actually just passed less than half a year. According to the data in the prospectus, in the whole year of 2019 and the first three quarters of 2020, Yixian e-commerce launched more than 1,500 SKUs in eye makeup, lip makeup, foundation makeup, cosmetic tools, gift boxes and skin care categories, and it can complete the whole process of a new product from concept proposal to development and launch within 6 months, while international brands usually need 7-18 months. Behind this speed, the perfect diary adopts OEM/ODM mode, that is, under the impetus of data, it is jointly developed and produced with manufacturers.

Because of this model, the gross profit of Yixian e-commerce is not disappointing, and its gross profit margin in 2018, 2019 and the first three quarters of 2020 is between 63% and 64%. (Of course, the gross profit of the beauty industry itself is not low. According to public information, the gross profit margin of Estee Lauder in the third quarter of this year was 76.8%, and the gross profit margin of L ‘Oreal in the first half of this year was around 73.1%. In contrast, Yixian e-commerce is not high. )

Generally speaking, in the prospectus, Perfect Diary defines itself as a "DTC(Direct-to-Customer)" brand. In the early stage, we made explosive products through a lot of online publicity and online celebrity KOL endorsement, and sold them through online channels.So that the brand can directly establish marketing and transaction contact with customers without channels such as distribution/consignment and store manager, and form an efficient feedback mechanism and data center.

In 2018, 2019, the first nine months of 2019 and the first nine months of 2020, the proportion of net income generated by Yixian e-commerce through DTC channels reached 91.1%, 88.1%, 88.7% and 86.7% respectively. In the whole year of 2019 and the first nine months of 2020, the number of DTC users of Yixian e-commerce was 23.4 million and 23.5 million respectively, up by 236.3% and 50% year-on-year.

The construction of digital middle platform based on social platform marketing to lay out a controllable supply chain system is the main reason why Yixian e-commerce stands out in the current beauty field.

This is the initial victory of the perfect diary.

As a new brand that has just experienced from 0 to 1, the bright performance growth rate is eye-catching and makes the capital crazy. And at this speed, the perfect diary also ushered in its anxiety.

Second, the anxiety of traffic stars

Although the highlight moment has arrived and the gross profit margin is not ugly, in fact, Yixian e-commerce is still in a state of loss as a whole.

DTC mode saves the cost of agents and other intermediate links for Yixian e-commerce. Yixian e-commerce has achieved a certain degree of profit before 2019, but by 2020, its adjusted net loss in the first three quarters exceeded RMB 1 billion.

In addition to the impact of the epidemic, the main reason for turning from profit to loss in the first three quarters of 2020 is the continuous investment of Yixian e-commerce in brand building-behind the track of high-speed driving, it is the great cost of maintaining the brand.

According to the prospectus, in order to vigorously promote its brands such as Perfect Diary, Little Odin and Wanzi Heart Selection, in the first three quarters of 2020, the sales and marketing expenses of Yixian E-commerce have reached 2.033 billion yuan, accounting for 62% of the revenue (the average gross profit margin in the same quarter is 63%), while in 2019, the proportion was only 41%.

These cost data seem to prove the general recognition of the perfect diary-its rise is equivalent to the victory of marketing.

Concerns from the outside world have emerged. Brocade, the analysis platform of listed companies, said that such losses are not common in beauty listed companies. For example, Yujiahui, Polaiya and Marumi, which have already become A-shares, are relatively stable in the first three quarters of 2020, and their net profit performance is much better when the revenue scale is 1 billion yuan and 2 billion yuan. At the same time, the article said that under such a loss, it is difficult to further increase the scale of the perfect diary because of the small differentiation of beauty products and the small overall growth rate of the industry.

Marketing and traffic have become people’s first impression of the perfect diary, which is a sharp double-edged sword.

We should know that Perfect Diary is almost synchronized with the rise of Little Red Book, Tik Tok and bilibili, which makes Perfect Diary seize the opportunity of this wave of traffic dividends, and because it makes full use of private domain traffic, it firmly holds the post-95 users in its hands with "face-to-face" service. However, omni-channel marketing has now become an e-commerce event, and channels and traffic centers will continue to change and shift. Only relying on traffic dividends to promote brand development may have a very limited effect.

For brands,Clever marketing methods and traffic effects can bring immediate growth effects, but relying on them alone can not create long-term brand value.Specific to the industry, beauty is an industry with low technical threshold and prevailing OEM. Compared with the ability of self-production and independent research and development owned by big brands, the threshold of OEM/ODM mode is much lower. At the same time, under the emerging traffic brought by new social platforms, the reproducibility of OTC brands is also increasing. It can be said that the perfect diary will face more homogenization competition, and the investment in marketing may be more.

For such "cross-examination", Huang Jinfeng finally made his own response.

He said that this year’s marketing costs have risen. The first reason is that many offline stores have been opened this year, and the rents of offline stores and employees’ salaries have still been paid during the epidemic. Second, Odin Jr. and Wanzi Xinxuan are still in their high-speed growth period, and they are in a big investment stage.

At the same time, in Huang Jinfeng’s view, every brand will have an investment period, and then it will enter a stable stage of profitability, and the return of Yixian e-commerce will be faster than that of traditional brands. "Our business model is slightly different from traditional brands. Traditional brands will take longer to build brands, and we can make brands grow faster based on the user-centered and Internet-based model. After the user purchases the product, his data models of repurchase rate, retention and product recognition can be calculated. After the initial investment, there will definitely be a payback period in a certain period of time in the future. " He said.

As for the next, Huang Jinfeng believes thatWhen the market is facing great challenges and changes, it should continue to invest.: "At this stage, Yixian’s e-commerce strategy is very clear. We will never back down and insist on investing. Although we are still far from the international beauty giants today, to be honest, we still have self-knowledge in our hearts, but when it is time to fight, we will never admit defeat, and we must invest when we invest. "

Obviously, in the short term, the perfect diary still can’t get rid of the label of "marketing". In order to get out of it faster and create greater value for the brand, the perfect diary is trying to start from other aspects.

Third, the challenges that face us

Yixian e-commerce is now releasing new signals and trying to add more keywords. Their direction is nothing more than high-end, multi-brand, multi-category and offline layout. Everything has just begun.

In October 2020, Yixian e-commerce announced the acquisition of a majority stake in Galénic, a high-end beauty brand under Pierre Fabre Group of France. And this business may officially kick off the "acquisition" trip of Yixian e-commerce.

Pierre Fabre is one of the largest dermatology and nursing groups in Europe, and it also owns brands with high reputation in skin care products such as Yayang. Official website of Galénic shows that the price of its products is about 20 ~ 100 euros, which is higher than the price of 49 ~ 129 yuan of Perfect Diary.

Huang Jinfeng explained that this "acquisition" is not a 100% acquisition, but a joint venture company has been established between the two parties. This is because the company will go to skin care products and high-end routes in the future, and it still needs to learn a lot. Pierre Fabre has invested in product research and development for many years, so I hope they can bring more help in research and development and production.

The acquisition of Galénic brand is obviously to supplement the shortcomings of the high-end product line and skin care products of Yixian E-commerce, and continue to export freshness to users, and then supplement their R&D and production capabilities with the deep cooperation with Pierre Fabre.

Yixian e-commerce has realized that a single category and brand image does not have long-term competitiveness, and it is best to become a beauty group with multiple categories and brands to cope with different market needs and time changes.

You know, before Galénic, Yixian E-commerce had three brand matrices, namely Perfect Diary, Little Odin and Wanzi Heart Selection, which basically covered the lower price range of makeup and skin care products, butWhat supports the achievements of Yixian e-commerce is actually only the main force of the perfect diary.

According to the prospectus, in the first three quarters of 2018, 2019 and 2020, the sales contribution of Perfect Diary accounted for 100.0%, 98.3% and 82.1% respectively, and the sales of Odin Jr. and Wanzi Xinxuan accounted for less than 20%. Just like the popularity and reputation of their products, most of them are concentrated on makeup categories such as eye shadow and lipstick at present, and the presence of skin care products is not high.

"Multi-brand" is the only way for most beauty groups to maintain their vitality. After all, a huge product matrix means more market share, endless explosions, and more stable vitality. At the same time,The interaction between high-end brands and low-end brands can also make the revenue and profit sources more diverse and healthy.According to public information, L ‘Oré al Group currently has 36 mature brands, including top brands such as helena rubinstein, and first-line cosmetics/skin care brands such as YSL, Giorgio Armani and Lancome.

The rapid upgrading speed of the beauty industry leads to high time cost of independent research and development, especially the threshold of high-end beauty and skin care products is much higher than that of beauty products. Such slow efforts are difficult to meet the growth goals of Yixian E-commerce today, and the efficiency of achieving the goal through acquisition is also much higher.

The trend of "high-end" has also gradually appeared in the marketing level of perfect diary. The spokespersons of Perfect Diary used to be young idols and traffic stars. Until October this year, Perfect Diary took Zhou Xun, who had endorsed Audi and Chanel-related products, as the first global spokesperson, and at the same time used European and American singer Poke Ye as the brand ambassador of Perfect Diary, emphasizing research and development stories while launching new products and endorsing the premium of the brand.

"For Yixian, it is a challenge to enter the skin care category and take the high-end route, but we are full of confidence." Huang Jinfeng said.

In addition to more levels of brands and categories,I’m afraid the perfect diary now needs more diversified sources of income.

At present, the sales of Yixian e-commerce still rely on the e-commerce platform. According to the prospectus, in the first three quarters of 2019 and 2020, the sales of its online platforms accounted for 96.7% and 91.3% respectively. At the same time, the main online sales channel is Tmall.

This situation leads to the fluctuation of its sales with the off-peak season of e-commerce. For example, its sales in shopping festivals such as "618" and "Double Eleven" account for a large part of Q2 and Q4. In such a special period of e-commerce sales, the perfect diary needs to prepare more inventory and higher marketing budget than usual, thus raising the operating cost.

Dependence on a single sales channel has become an urgent problem to be solved. Therefore, the offline store that traditional brands love has also become one of the new stories to be told in the perfect diary.

Up to now, Yixian e-commerce has about 218 stores online, covering more than 100 cities. Feng Qiyao, president of the new retail business unit, is responsible for the offline layout of the company. Facing the reality that Yixian e-commerce relies on online channels, he responded that as a beauty company that started from e-commerce, Yixian has been involved in offline business for less than two years, so the current income ratio does not explain the problem, but he has always believed in the importance of new retail to enhance user value.In the future, we will make great efforts to invest offline, and we will remain self-employed rather than joining in order to establish a moat of brands in the future.

Shanghai Perfect Diary Cosmetics Store, picture from IC photo.

However, offline stores are different from the good times online. This is a business that tests the management and expansion ability of stores, which will also bring new pressure to the future operation of Perfect Diary.

Fourth, fight for the right to speak

Yixian E-commerce in the spotlight has attracted the attention of all startups and investment companies, not only because it has flourished as a new brand in just three years, but also behind it represents the future of this wave of new beauty brands.

There is more than one "perfect diary".

Often appearing on the list of e-commerce platforms and in major KOL live broadcast rooms, there are Hua Xizi, who is often compared with Perfect Diary, and domestic brands such as Tangduo, Winona, Mary Daijia, Zhiyouquan, Yuze and HomeFicialPro. On the other hand, Lin Qingxuan, Dai Chunlin, Xie Fuchun, Baique Ling, Marubi and so on, who also rely on e-commerce platforms and marketing to "renovate" their brands.

According to public information, the sales of Huaxizi are expected to be close to 3 billion by the end of the year, and the momentum of Huaxizi is not weak in terms of the exposure of social platforms, sales growth rate and double eleven.

Facing the competition of similar brands under the same banner of "domestic products", the perfect diary after listing needs to strengthen the moat and maintain the market advantage. There will be a lot to see in the competition between them.

butHu Wei believes that, in essence, the competition of domestic beauty brands has actually reached the stage of competing for definition and leading "Chinese aesthetics".Whose products can take the lead in winning young people in China and even in the world will lay the foundation for competing for the right to speak as a beauty leader.

More domestic brands often choose to interpret their brand image in Chinese style, and instill an emphasis on aesthetics in this generation of young people. Among them, Hua Xizi chose the cuckoo with oriental face as the image spokesperson, and at the same time deliberately emphasized the Chinese style and ethnic minority elements in products and packaging, and promoted it overseas. The marketing action of its new gift box set in overseas KOL was quite frequent. The perfect diary emphasizes "developing products based on the facial and skin characteristics of Asian women", trying to define the beauty needs of these post-95 s.

However, the young groups they are targeting are actually the ones that international brands are eyeing now.

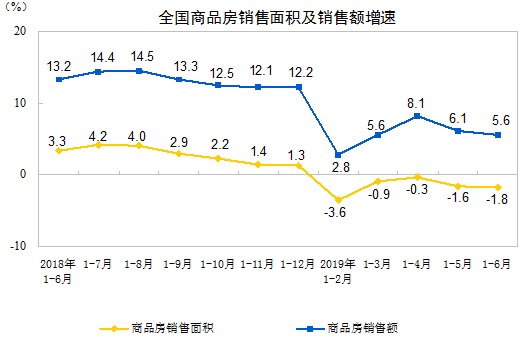

International brands have lowered their posture. Who makes China market become the largest and most competitive beauty market? Yang Donghao, CFO of Yixian E-commerce, gave a data: 60% of the growth in the beauty field in the next 5-10 years will come from China. "He who gets China gets the world." Huang Jinfeng also said that this year’s "Double Eleven" has become a very important node in the field of beauty. Because of the epidemic, the investment of international beauty giants in China reached its peak this year.

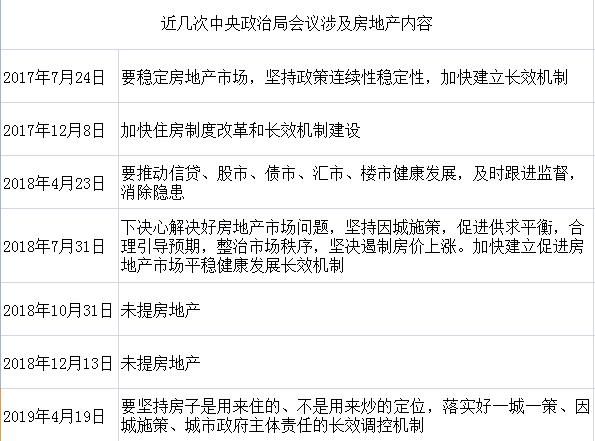

Despite the rise of domestic products, they still have to face some realities: according to public information, 80% of the cosmetics market in China is still occupied by overseas brands, and domestic brands are mainly concentrated in the low-end market.

And most of the domestic brands that have survived from the only market often have a common fate-to become flat substitutes from big-name foundries, or "stepping stones" on the road of "cost-effective girls" to big brands. Standing at the top of the pyramid of earning money and brand value are always international big-name products: they all have a fixed class and consumer groups behind them, and the higher the brand, the less mobile its user class is.

The beauty market as a whole is still in the hands of international brands, and the data comes from Tmall and public information.

Perfect diaries have come to people’s field of vision with new ways of playing, and the opportunity of domestic beauty products market has surfaced behind the popularity.

"China must have a chance to give birth to a new L ‘Oreal." The dialogue between Huang Jinfeng, the founder of this perfect diary, and Zhang Lei, Gaoyan Capital, is often circulated in public reports. However, Chen Yuwen, co-founder of Yixian E-commerce, once told China Entrepreneur Magazine, "If one day, we have the opportunity to become a leading group in China Beauty Group, in fact, we don’t want to be L ‘Oreal in China, we hope to be a perfect diary of the world."

Caution in words can’t stop people from comparing domestic brands with international brands.The next situation of the perfect diaries will become the vane of whether domestic beauty brands can make their mark.

The perfect diary is ahead of the road to listing, but it is a difficult problem for domestic beauty brands to seize the right to speak from mature beauty brands, and they are still at the same starting line. It’s not easy to create and lead a new trend. Before oriental aesthetics goes international, the premise is to ensure that it can cater to young people’s aesthetics for a long time, so that the unconventional "online celebrity products" can become enduring classic brands.

In the final analysis, whether the brand can last for a long time depends on whether the product is easy to use.

If you are optimistic enough,Perfect diaries still hope to become synonymous with oriental make-up, and rank among the first-line beauty brands with the reputation of domestic beauty. It’s just a long road.

# Tiger Sniff has formed a Hushanxing Value Investment Exchange Group, in which there are more high-quality exchanges and discussions on the investment value of listed companies. If you are a member who pays more attention to the industry and the company’s texture itself rather than simply chasing up and down, please join us ~ the review is strict (for group friends), and please fill in it carefully.