[Global Network reporter Yang Feifei Wei Yue] South Korean President Moon Jae in paid a four-day state visit to China from December 13th to 16th. He not only started diplomatic activities in China, tasted Chinese breakfast, but also experienced a mobile payment. On the 18th, just the second day after returning to China, Moon Jae in decided to rapidly innovate its public network and cancel the unnecessary security plug-in activeX in electronic transactions.

South Korea’s "Central Daily News" reported on December 18th that Park Soo-hyun, spokesman of South Korea’s Presidential Palace Cheongwadae, said on the 18th that South Korean President Moon Jae in said that when using public networks, the goal should be to cancel some unnecessary plug-ins during installation procedures, and quickly change administrative procedures and improve relevant legal systems before 2018.

It is reported that South Korea’s active X is a security program installed during electronic transaction settlement, but there have been criticisms that activeX has slowed down the transaction. Although active X has disappeared in other countries, 44 of the top 100 websites in Korea still use Active X.. Previously, in March 2014, when former South Korean President park geun-hye held a seminar on system reform in Cheongwadae, he said that the "Chien Yong Yi Coat" in the Korean drama "You from the Stars" caused a wave of buying in China, but it could not be bought because of active X, so the government needed to start the work of eliminating Active X.

When Moon Jae in had breakfast at Yonghe Soymilk in Beijing, he really felt the necessity of canceling unnecessary plug-ins.

Moon Jae in scanned the QR code on the table for settlement after ordering. At that time, Moon Jae in showed interest in China’s mobile phone checkout system and asked, "Is this enough to pay the money?" Lu Yingmin, the South Korean ambassador to China, also said that "most of China uses mobile phones to settle accounts."

This is not the first time that foreign leaders have been "circled" by China’s mobile payment.

We are like "hillbillies"!

On August 20th, the Straits Times published an article entitled "2017 National Day Mass Meeting: When lim swee say felt like a" hillbilly "in the smart city of Shanghai".

At the beginning, the article tells the story of Singapore’s Minister of Manpower Lin Ruisheng buying chestnuts in Shanghai a few years ago. A few years ago, lim swee say saw people queuing up to buy chestnuts. They just shook their mobile phones and left without paying cash. Lim swee say thought it was a special discount, so when it was his turn, he told the vendor that I didn’t need a discount, and I would pay the full price. But the result is that people are using WeChat to pay for scanning the QR code of vendors. Mr. Lin feels like a hillbilly.

The person who tells this story is none other than Singapore Prime Minister Lee Hsien Loong.

Lee Hsien Loong used this story to tell Singaporeans that Singapore’s development has fallen behind some smart cities in China. In terms of electronic payment, China has been at the forefront.

Lee Hsien Loong said, so when China tourists find it necessary to use cash in Singapore, they will ask, "Why is Singapore so backward?" Therefore, Singapore also plans to build a smart country to enhance the overall economic productivity and make life more convenient. Lee Hsien Loong said that all kinds of systems in Singapore must be simplified and integrated, and the relevant financial management departments have already begun to implement them.

China Mobile Payment has long caused envy among many foreigners.

In fact, the development of mobile payment not only in Singapore but also in China has long aroused the envy of many foreigners.

In February this year, the Financial Times published an article entitled "Compared with China, the mobile payment market in the United States looks like a dwarf". Forrester described the payment scene in the United States in his report: "Old habits are hard to disappear. In front of the checkout counter, people are still more willing to take out their credit cards instead of taking out their mobile phones to sweep them."

"China’s rapid push for near-end payment is largely based on its late-comer advantage — — Unlike the United States and other countries and regions, China does not have a solid credit card culture. It is precisely because of this that China has jumped directly from the cash payment stage to the mobile payment stage, "market research institute eMarketer said in a research report.

After experiencing mobile payment in China, many foreign netizens said that it was very easy to use!

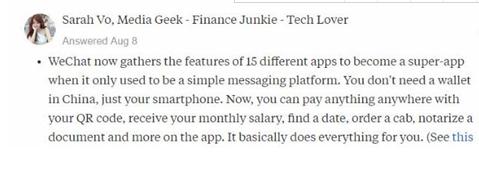

Netizen: Although WeChat started as a communication application, it has now integrated the functions of 15 applications, which is very powerful. In China, you don’t need a wallet at all, just a mobile phone. You can buy anything anytime and anywhere by scanning the code. You can check your salary, make friends, call a car, send files, and do anything.

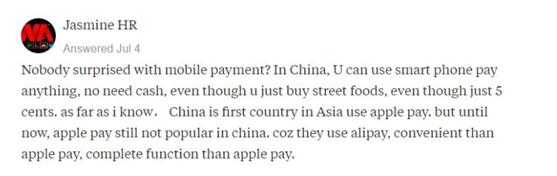

User Jasmine HR: Is no one shocked by mobile payment? In China, you can buy anything as long as you have a mobile phone. You don’t need cash at all. Even if you buy a roadside stall, you can use your mobile phone for only half a cent. China is the first country in Asia to open Apple Payment, but Apple Payment is still not popular in China. Because China’s Alipay is so convenient, its function is more powerful than Apple’s payment.

Do you think China is the most successful country in mobile payment?

Netizen Vital Khali: It must be! So far, China is the country with the strongest mobile payment, and there is no one. In China, mobile payment has become a part of people’s lives: transferring money, shopping, eating, watching movies, paying rent and paying bills. Only unexpected things can’t be done without mobile payment. (Global Network Comprehensive China Journal, Singapore Straits Times, etc.)